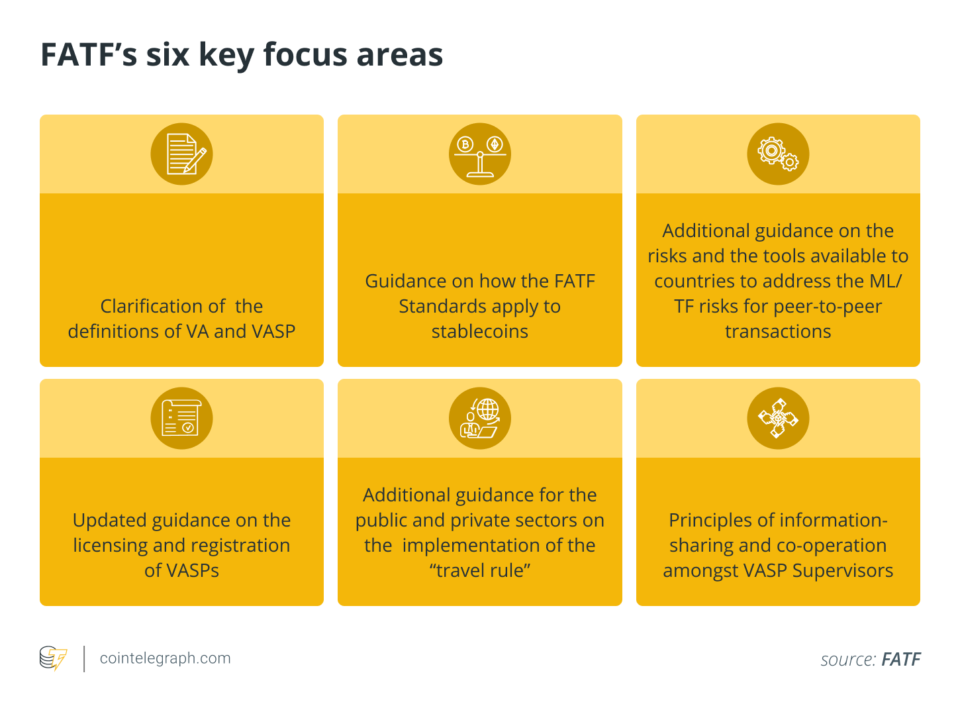

The Financial Action Task Force (FATF) has released its long-awaited guide virtual assets, setting standards that have the potential to reshape the crypto industry in the United States and around the world. The guidelines address one of the most important challenges facing the crypto industry: convincing regulators, lawmakers and the public that it does not facilitate money laundering.

The guidelines specifically target those parts of the crypto industry that have created significant regulatory uncertainty recently, including decentralized finance (DeFi), stablecoins and non-fungible tokens (NFTs). The guidelines largely follow the emerging approach of US regulators to DeFi and stablecoins. On the upside for the industry, the FATF appears to be less aggressive towards NFTs and arguably encourages the assumption that NFTs are not virtual assets. However, the guidelines open the door for members to regulate NFTs when used for “investment purposes”. We anticipate this forecast will give a new boost to the NFT rally, which will take place for most of 2021.

Related: The FATF draft guide aims to achieve DeFi compliance

Expansion of the definition of virtual asset service providers

The FATF is an intergovernmental organization whose mission is to develop strategies to combat money laundering and the financing of terrorism. Although the FATF cannot issue binding laws or guidelines, its guidelines have a significant influence on the anti-terrorism and anti-money laundering (AML) laws of its members. The US Treasury Department is one of the government agencies that generally follows and implements regulations under the guidelines of the FATF.

The highly anticipated FATF guideline takes an “expansive approach” to broadening the definition of Virtual Asset Service Providers (VASPs). This new definition includes the exchange between virtual assets and fiat currencies; Exchange between multiple forms of virtual assets; the transfer of digital assets; the safekeeping and management of virtual assets; and participating in and providing financial services relating to the offering and sale of a virtual asset.

Once a company is marked as a VASP, it must meet the applicable requirements of the jurisdiction in which it operates, which generally includes implementing anti-money laundering (AML) and counter-terrorism programs, and must be licensed with its local government or be registered and subject to the oversight or supervision of that government.

Separate from this is the FATF Are defined virtual assets (VAs) in general:

“A digital representation of value that can be traded or transmitted digitally and used for payment or investment purposes.” However, the exception is “digital representations of fiat currencies, securities and other financial assets, which are already mentioned elsewhere in the FATF Recommendations be treated”.

In summary, the FATF definition of VAs and VASPs appear to extend the AML, counter-terrorism, registration and surveillance requirements to most actors in the crypto industry.

Effects on DeFi

The FATF guidelines on DeFi protocols are ambiguous. The FATF begins by stating:

“The DeFi application (ie the software program) is not a VASP according to the FATF standards, as the standards do not apply to the underlying software or technology …”

The guide doesn’t stop there. Instead, the FATF then declares that DeFi protocol creators, owners, operators or others who retain control or sufficient influence over the DeFi protocol “can fall under the FATF definition of a VASP if they are VASP- Provide or actively enable services “. The guideline further explains that owners / operators of DeFi projects who are qualified as VASPs are differentiated “by their relationship to the activities carried out”. These owners / operators can exercise sufficient control or influence over assets or the project log. This influence can also come from maintaining “an ongoing business relationship between you and the users” even if it is “exercised through a smart contract or, in some cases, voting protocols”.

Consistent with that language, the FATF recommends that regulators not simply accept claims of “decentralization” and instead exercise their own due diligence. The FATF even goes so far as to suggest that a jurisdiction could order the establishment of a VASP as an obligated party if a DeFi platform is not operated by any company. In that regard, the FATF has done little to improve the regulatory status of most of the players in DeFi.

Related: DeFi: Who, what and how do you regulate in a borderless, code-controlled world?

Effects on stablecoins

The new instructions affirmed the organization’s previous position that stablecoins – cryptocurrencies whose value is tied to a store of value like the U.S. dollar – are subject to FATF standards as VASPs.

The guide addresses the risk of “mass adoption” and examines specific design features that influence the risk of AML. In particular, the guidelines refer to “central control bodies for stablecoins” which “are generally covered by the FATF standards” as VASP. Based on its general approach to DeFi, the FATF argues that claims of decentralized governance are insufficient to evade official control. Even if the control body of stablecoins, for example, is decentralized, the FATF encourages its members to “identify obliged entities and … to reduce the relevant risks … regardless of institutional structure and name”.

The guidelines urge VASPs to identify and understand the AML risk of stablecoins prior to launch and on an ongoing basis, and to manage and mitigate the risk prior to the implementation of stablecoin products. Finally, the FATF suggests that stablecoin providers should seek a license in the jurisdiction in which they primarily conduct their business.

Forwarded: Regulators are coming for stablecoins, but where should they start?

Effects on NFTs

Along with DeFi and stablecoins, NFTs have grown in popularity and are now an important pillar of the modern crypto ecosystem. In contrast to the expansive approach to other aspects of the crypto industry, the FATF notes that NFTs “generally do not qualify as [virtual assets] under the FATF definition. ”This arguably creates the assumption that NFTs are not VAs and that their issuers are not VASPs.

Similar to its approach to DeFi, however, the FATF emphasizes that regulators “should consider the nature of the NFT and its function in practice, not what terminology or marketing terms are used”. In particular, the FATF argues that NFTs “used for payment or investment purposes” can be virtual assets.

While the guidelines do not define “investment purposes,” the FATF likely intends to include those who buy NFTs with the intention of selling them at a later date for a profit. While many buyers buy NFTs because of their connection to the artist or work, much of the industry buys them because of their potential for appreciation. While the FATF’s approach to NFTs does not appear to be as far-reaching as its guidelines for DeFi or stablecoins, FATF countries can rely on the language of “investment purposes” to establish stricter regulations.

Related: Non-fungible tokens from a legal point of view

What the FATF guideline means for the crypto industry

The FATF guideline closely tracks the aggressive stance of US regulators regarding DeFi, stablecoins and other important parts of the crypto ecosystem. As a result, both centralized and decentralized projects are coming under increasing pressure to adhere to the same AML requirements as traditional financial institutions.

In the future, as we have already seen, DeFi projects will dig deeper into DeFi and experiment with new governance structures such as decentralized autonomous organizations (DAOs) that are approaching “real decentralization”. This approach is also not without risk, as the far-reaching definition of VASPs by the FATF causes problems with key signers of smart contracts or owners of private keys. This is especially important for DAOs as signatories could be classified as VASPs.

Given the far-reaching way in which the FATF interprets who “controls or influences” projects, crypto entrepreneurs will face an uphill battle not only in the United States but around the world as well.

This article was co-authored by Jorge Pesok and John Bugnacki.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect the views and opinions of Cointelegraph.

This article is for general informational purposes and is not intended and should not be construed as legal advice.

Jorge Pesok is General Counsel and Chief Compliance Officer for Tacen Inc., a leading software development company that develops blockchain-based open source software. Prior to joining Tacen, Jorge gained extensive legal experience advising technology companies, cryptocurrency exchanges, and financial institutions before the SEC, CFTC, and the DOJ.

John Bugnacki serves as Policy Lead and Law Clerk for Tacen Inc. John is a governance, security, and development professional. His research and work focused on the critical intersection between history, political science, economics and other areas to enable effective analysis, dialogue and engagement.