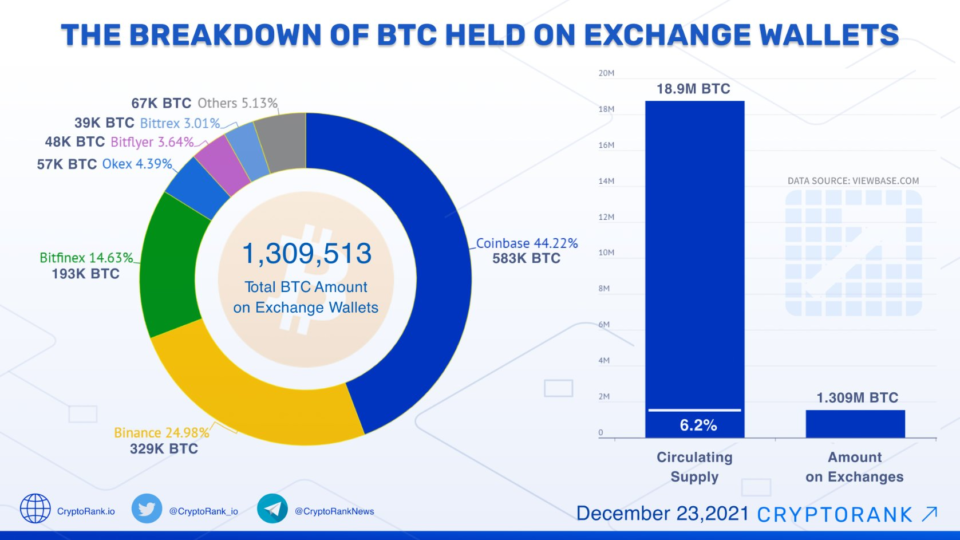

In the good news for an orange Christmas, Bitcoin (BTC) the supply is drying up to lows that have not been seen in years. In one recently tweet CryptoRank only holds 6.3% of total Bitcoin supply, or 1.3 million BTC, on cryptocurrency exchanges.

The falling supply is nothing new and has been trending down since Bitcoin halved in 2020 when the BTC block reward has been cut in two. BTC availability on exchanges followed suit and slowly declined over the past year. Exchange wallets taken into account 9.5% of the BTC offering in October 2020, just before the 2020 Christmas high, and 7.3% in July of this year. The December figure of 6.3% is the lowest recorded in 2021.

Interestingly, Coinbase’s BTC wallet dominance is also slipping. The American exchange used to hold more BTC than all other exchanges combined. Its dominance decreased from 50.52% to 40.65% in the past year.

The message follows a series of positive price metrics that meshed Bitcoin’s upward movement. First, the illiquid BTC supply has iced over for winter as the BTC supply that is transitioning from a “liquid” to an “illiquid” state is now 100,000 BTC per month. Essentially, more BTC is locked in cold stores than the amount is mined.

Glassnode, the on-chain analytics company, shared more bullish news on market behavior. The 7-day moving average for BTC exchange inflow volume only achieved a 5 month low of 978,452 BTC and trending downwards from week to week. The supply shortage on the exchange can persist if less and less BTC is sent to the exchanges.

Additionally, it is important to note that many individual investors and some businesses save their BTC on exchangessuggesting that the “illiquid” BTC could be even lower. Some BTC traders would leave the custody of their keys to the exchanges instead of taking their BTC offline to a cold store.

Related: Bitcoin must vacate $ 51,000 to reduce the likelihood of a new sell-off by BTC whales

Not surprisingly, the CEO and co-founder of Binance Changpeng Zhao encouraged hot wallet practice‘Despite the best efforts of Bitcoiners like Andreas Antonopolous to ensure that’not your keys, not your bitcoin‘is part of the everyday BTC mantra.

As a result, 1.3 million BTC, while resting on exchanges, may not “circulate” and may actually add to the illiquid supply.

Still, despite calls for a “Santa Rally”“Against the background of bullish analysis, the bears are not out of the woods yet. ONE tweet from BullRun Invest using Glassnode data shows that 24.6% of total BTC supply is above the price of $ 47,000.

It suggests that around a quarter of the BTC bought at this price level is currently underwater. When BTC doesn’t make any headway into the 50s, tomorrow there may be fewer presents under the tree.