Sean Fanning is Vice President at OpenView‘s investment team. Prior to that, he led the company’s proactive portfolio management function and served as director of corporate development, assisting the portfolio with inorganic and balance sheet initiatives.

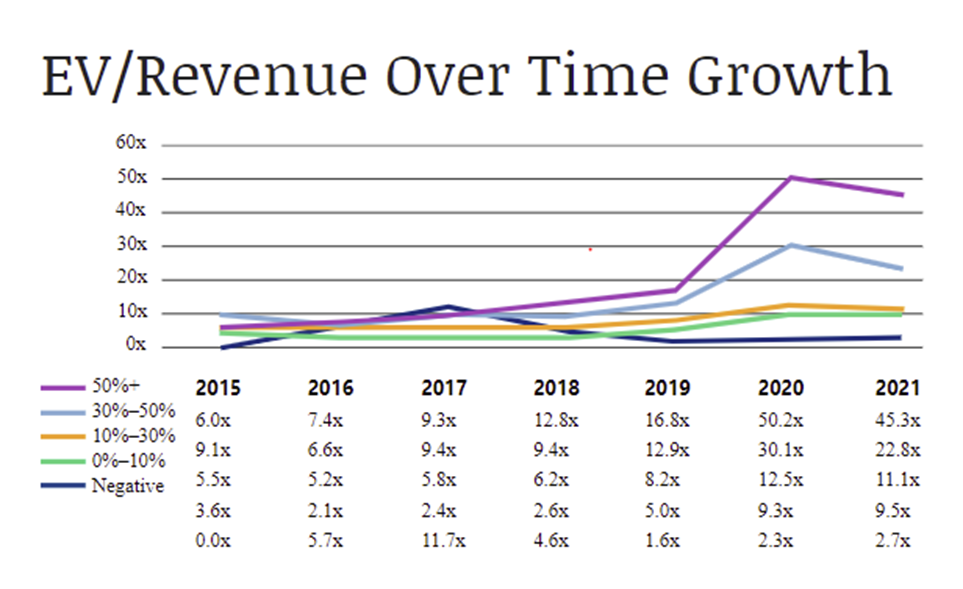

The flow of capital in SaaS is becoming more and more divided. There are the “haves” (public companies with a turnover growth of over 30%) and the “have nots” (all others) of B2B software.

The following graphic shows how drastically the “have” have separated from the others. With an average EV / Revenue multiple of + 28.5x for companies that have grown over 50% and + 9.9x for companies that have grown 30-50% since 2019, compared to just + 2.9x for those that have grown 10-30%.

The real trick is figuring out why certain companies are “have” and how they stay so. In other words, what’s the reason for their oversized reviews about companies like Zoom, Datadog, Monday.com, and Asana? More importantly, are there strategies or tactics that management teams can use to optimize this type of outcome?

EV / revenue growth over time. Credit: OpenView partner

Recent research shows that there are three important steps to becoming a “have”:

- Continuous execution against large and growing market opportunities.