GlobalBees, which is one of the largest Series A financing rounds joined the Unicorn Club in India earlier this year as the New Delhi-based company is expanding its Thrasio-like brand house.

Premji Invest, the investment firm controlled by the Indian tycoon Azim Premji, led the nine-month-old startup’s Series B funding round, the young company announced in a government filing. The round, roughly $ 110 million, valued GlobalBees at over $ 1.1 billion, the filing shows.

Steadview Capital and existing investors SoftBank and FirstCry also participated in the $ 110 million equity round. Trifecta Capital invested an additional US $ 30 million in debt capital in the new round.

Founded by Nitin Agarwal, formerly Edelweiss Financial, and Supam Maheshwari, a founder of FirstCry, GlobalBees acquires and partners with digitally native brands in categories such as beauty, personal care, home and kitchen, grocery and nutrition, and sports and lifestyle, with sales rates ranging from $ 1 million to $ 20 million.

GlobalBees is helping these firms scale and sell in marketplaces and through other channels in India and outside of the South Asian marketplace.

“We have created and connected with brands in the past and found that most of those brands are reaching a level beyond which it becomes too difficult to scale,” Agarwal said in an interview with TechCrunch earlier this year. He did not want to comment on the new fundraising campaign.

“Supam and I have been talking about this for several years, trying to find ways to revolutionize this market. We believe that there is an opportunity to create a new, digitally native brand house. “

At the time, Agarwal said GlobalBees was looking to acquire up to three dozen brands. Indian news and analytics publication CapTable, which covered GlobalBees’ talks to open a round of unicorn evaluation in October, said at the time that GlobalBees was at various stages of the talks with Do business with at least 15 brands.

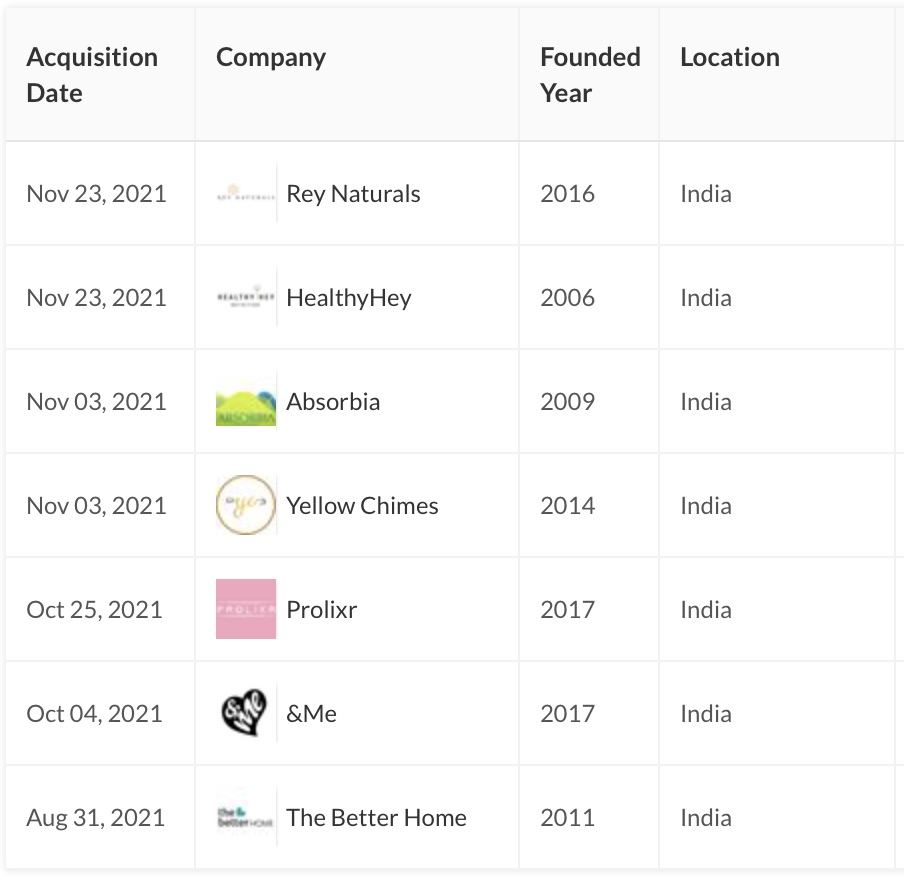

Some of the brands GlobalBees has acquired in the past few months. (Data: Tracxn)

Numerous startups in India today are trying to replicate the model popularly known as the Thrasio model. (Though it’s worth noting that it took Thrasio about two years to become a unicorn.)

Mensa Brands, a similar company of the former CEO of the fashion e-commerce Myntra, recently initiated a Series B funding round of $ 135 million which the startup valued at over $ 1 billion. It was six months old when the funding was announced. Titan Capital, which has supported around 200 startups in India, has invested in Powerhouse91. 10club, another similar startup, Raised $ 40 million earlier this year– although much of it was in debt.

Like Thrasio, several of these companies are trying to acquire brands that sell mid-range to high-end products in categories where competition is limited. In fact, some of the categories common with these brands are so underestimated that even Amazon and other ecommerce companies haven’t explored them through their private label ecosystems.

With more than 800 brands, India is rapidly emerging as a rapidly growing market for direct-to-consumer brands.

Many investors believe that the Amazons and flip carts of the world paved the way for digital commerce and smarter and more profitable businesses can build on them.

“Newer models of social commerce will continue to dig deeper into Bharat, while income-based funding models offer an alternative funding option for stock-dilution-conscious smaller D2C brands. At the same time, consumers are demanding a smooth journey after checkout (automatically filled in card / customer details, RTO forecasts, one-step checkout). Startups that offer shovels in the gold rush (Shiprocket, GoKwik) will have the potential to make big profits ”, a current analysis said.

GlobalBees joins over 40 other India-based startups that joined the Unicorn Club this year, up from 11 last year. Several high profile investors, including SoftBank, Falcon Edge Capital, and Tiger Global, have doubled their investments in the South Asian market in recent quarters.