In recent years the Stock-to-flow model suggested by, proposed by Plan B has become very famous. A quantitative study published on the planbtc.com website shows the model and prediction that Bitcoin (BTC) could reach a capitalization of $ 100 trillion. Obviously, the crypto industry, myself included, was intrigued by the logic of the model, and even more so by the idea that it could reach and exceed $ 100,000 as early as 2021.

In fact, the stock-to-flow model assumes that there is a connection between the amount of a precious metal that is mined each year (flow) and the amount previously mined (stock).

For example, the gold that is mined each year is just under 2% of the gold in circulation (owned by central banks and private individuals). At today’s production rate, it takes over 50 years to double circulation, which effectively makes gold a scarce commodity.

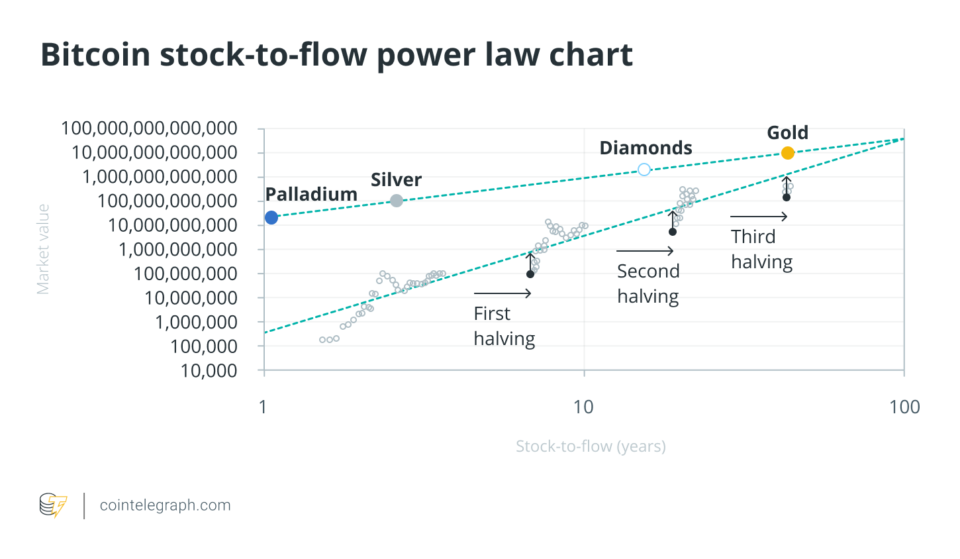

PlanB hypothesizes that Bitcoin, considered by many to be digital gold, can follow this relationship between the amount in circulation and the amount mined in the year, and proposes a Cartesian plane (with a logarithmic axis in both the X and also in the Y-axis), in which Bitcoin’s growth over time follows a growth that can be described by a regression line (with power law formula).

The bounces that are detected roughly every four years are due to the fact that the expected remuneration is halved or halved for each block mined. Bitcoin’s protocol stipulates that every 210,000 blocks, the number of bitcoins allocated to each block is halved to the miner who wins the cryptographic test.

Related: Predicting Bitcoin Price Using Quantitative Models, Part 2

Satoshi Nakamoto, when he thought of the halving phenomenon, probably assumed that the price would double every four years. Meanwhile, PlanB has shown that Bitcoin has moved around an exponential function in the first 10 years of history, which means that the price increases tenfold with each halving instead of doubling.

Reason # 1

The first reason is this: Can we really expect Bitcoin to reach $ 1 billion by 2039?

A billion per Bitcoin would mean that the capitalization would reach about 20,000 trillion dollars, “only” 130 times the current value of the stock markets. Not to mention that, according to this model, the value should increase tenfold in the following years.

Of course, this is also unthinkable for the next two points.

Reason # 2

The second reason is that the model does not take into account demand, only scarcity, and Bitcoin is no longer the only crypto-asset in circulation. Its dominance is waning due to the many emerging projects that inevitably divert attention (and investment) away from digital gold.

In fact, it is precisely the neglect of the demand effect that makes the stock-to-flow model incomplete; a scarce good has value if people want to buy it. A painting by an unknown artist, even if it is beautiful and belongs to a collection of a few paintings, is worthless if there is no interest from someone who wants to own it.

I discussed this in my article a few months ago when I proposed a model of bitcoin prediction based on demand rather than scarcity. For Bitcoin to be worth a billion, according to this model, around four trillion wallets would have to be in circulation – a scenario that is hardly imaginable.

Related: Predicting Bitcoin Price Using Quantitative Models, Part 3

Reason # 3

The third reason lies in the stock-to-flow construction itself.

If, instead of doing the regression from the beginning to the present, we assumed that we had done it at the end of each period before the halving, that would be Regression would always have been different.

If we had calculated that the stock would flow at the end of the first halving, the market capitalization of diamonds worldwide would have been forecast as early as September 2016. At the end of the second halving in August 2016, however, the regression line indicated that Bitcoin’s capitalization would match that of gold in 2021 while we are still a tenth of the way there.

Related: Predicting Bitcoin Price Using Quantitative Models, Part 4

So the path of Bitcoin in the Cartesian plane with a double logarithmic axis proposed by PlanB can most likely not be viewed as a straight line, but as a curve (with a mathematical description that has yet to be explored) that tends to change over time to flatten, which effectively invalidates the overly optimistic forecast of the stock-to-flow model proposed by PlanB.

This article does not provide investment advice or recommendation. Every step of investing and trading involves risk, and readers should do their own research when making a decision.

The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph.

Daniele Bernardi is a serial entrepreneur constantly on the lookout for innovation. He is the founder of Diaman, a group dedicated to developing profitable investment strategies that recently successfully issued the PHI Token, a digital currency with the aim of fusing traditional finances with crypto assets. Bernardi’s work focuses on developing mathematical models that simplify the decision-making processes of investors and family offices to reduce risk. Bernardi is also chairman of the investor magazines Italia SRL and Diaman Tech SRL and CEO of the asset management company Diaman Partners. He is also the manager of a crypto hedge fund. He is the author of The Genesis of Crypto Assets, a book on crypto assets. For his European and Russian patents in the field of mobile payments, he was recognized by the European Patent Office as an “inventor”.