Firebox, a software platform for custody, management of treasury operations, access to DeFi, minting and burning of tokens, and management of digital asset operations, announced that Aave Arc, a new approved DeFi liquidity pool for institutions, Now with Fireblocks as the first active live, Whitelister is for the record.

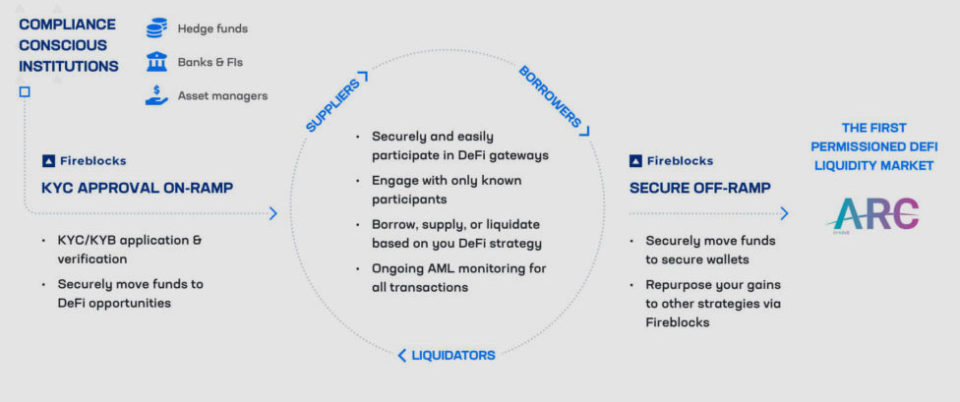

Aave Arc is a DeFi liquidity market that complies with AML regulations and in which all participating institutions have to undergo a Know Your Customer (KYC) verification. The protocol provides a separate provision of the Aave V2 liquidity pool for institutional actors and enables institutions on the whitelist to securely participate in DeFi as liquidity providers and borrowers.

Now Fireblocks users who volunteer to be whitelisted through a KYC process can access Aave while benefiting from Fireblocks industry leading security. In general, approved protocols like Aave Arc can offer the decentralization benefits of DeFi, while only approval (white listing) for KYC / AML purposes can be more centralized.

“DeFi represents a powerful wave of financial innovation, including transparency, liquidity, and programmability – and has been inaccessible to traditional financial institutions for far too long. The introduction of Aave Arc enables these institutions to participate in DeFi in a compliant manner for the first time. “

– Stani Kulechev. Founder and CEO of Aave

Support of approved DeFi on Aave Arc as whitelister

As the first active whitelister from Aave Arc, Fireblocks has developed a framework for whitelisting institutions that refers to globally recognized KYC / CDD / EDD principles in accordance with the FATF guidelines.

With this framework, Fireblocks is able to verify the identity and beneficial ownership of customers of a legal entity as well as continuously monitor the Aave Arc pool and its participants.

Initially, Fireblocks approved 30 licensed financial institutions to participate in Aave Arc as suppliers, borrowers and liquidators. Institutions include Anubi Capital, Bluefire Capital (acquired by Galaxy Digital), Canvas Digital, Celsius, CoinShares, GSR, Hidden Road, Ribbit Capital, and Wintermute.

Fireblocks’ approach has been approved by Aave Protocol Governance and all future whitelister institutions must meet or exceed these standards if approved by Aave Protocol Governance.

How to access Aave Arc using Fireblocks

Getting started with Aave Arc is a simple process with Fireblocks:

- Apply for access on this page – Do KYC with Fireblocks to become a supplier, borrower and / or liquidator on Aave Arc’s whitelist. You must be a Fireblocks user to join as a supplier or borrower.

- Access Aave Arc through Fireblocks’ DeFi gateways – Aave Arc is another market on Aave that users can access through their web3 app once they are whitelisted.

FAQ

1. What is a “whitelister”?

Whitelisters are regulated custodians and financial institutions that are approved for KYC and whitelist their customers to participate in the KYC’d DeFi protocol marketplace.

2. Are there any other institutions besides Fireblocks users authorized to participate in the Aave Arc liquidity market?

Fireblocks is the first regulated company to be approved as a whitelister for KYC customers for Aave Arc. In the future, further regulated units will be added, which customers can also put on the whitelist.

3. Does Aave also whitelist institutions in the market?

Aave only recommends institutions to trusted regulated entities (like Fireblocks), which are the only ones able to whitelist KYC and the recommended institutions.

4. Does the functionality of Aave Arc differ from standard Aave?

The user interface and the app user interface are generally the same. The main difference is how it interacts with providers and borrowers on the whitelist, and there is a smaller subset of tokens (WBTC, ETH, USDC, and AAVE).

5. What roles can recognized institutions play at Aave Arc?

- Suppliers – Earn interest for providing liquidity to the marketplace.

- borrower – Provide collateral to take out loans in the liquidity market.

- Liquidators – If a borrower fails to meet their terms, trustees enforce “good behavior” by buying a portion of the debt at a predetermined discount. You can find out via API or smart contract who is not complying with your credit terms.