In the latest fintech mega-round, Brex has confirmed it raised $ 300 million in a Series D-2 round that increases its valuation to $ 12.3 billion.

TechCrunch in October was the first to report that Brex raised the capital and achieved Dekacorn status. Greenoaks Capital and TCV jointly led the financing, raising a total of $ 1.2 billion for the three-year-old San Francisco startup.

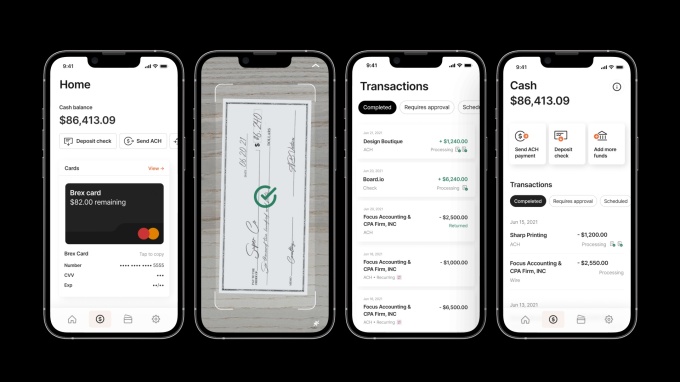

Brex began life with an emphasis on the provision of credit cards, mostly aimed at startups and SMBs. It has gradually developed its model further with the aim of serving these companies as a financial service provider from a single source. Last April, Brex said it had combined Credit cards, business cash accounts and new expense management and billing software “all together in a single dashboard” as part of A service called Brex Premium, which costs $ 49 a month. Today the company focuses on the corporate card product it has developed since its inception, as well as banking and expense management products. Or, to put it more simply, it should serve as a “financial operating system” for its customers.

The most recent increase follows, according to co-CEO and co-founder Henrique. to a year in which sales “more than doubled” Dubu grasswho refused to divulge hard numbers. Existing investors made approx. 95% of the Series D-2 round contestants, he added.

“We didn’t open up to new ones because we had so many new, big-walled investors who we had promised to give more allocation over the years.” Dubu grass said TechCrunch. “They felt sure we had achieved what we said we would achieve, which gave us some credibility.”

In connection with the funding announcement, Brex also announced that it has hired a manager from Meta: Karandeep Anand. Anand was named the company’s chief product officer after serving Meta’s business product group, serving more than 200 million companies worldwide. Anand previously spent 15 years at Microsoft, where he led the product management strategy for Microsoft’s Azure cloud and developer platform efforts. The CEO will lead the expansion efforts of Brex’s product portfolio, into which much of the new capital will flow.

“Karandeep is an engineer from the ground up, so product and technology-oriented, but also business and customer-oriented,” Dubugras told TechCrunch. “He’s unique in that regard, and that’s especially important for Brex. Our software and card affect most of the employees in a company, even though it is the CFO who buys them. Since we want to offer a consumer-like experience, he will help there. “

For his part, Anand described Brex as a “market disruptor”.

“The ability to innovate in financial products to create business opportunities for millions of people and businesses around the world is incredibly exciting,” he said in a written statement. “Brex offers tremendous opportunities and I am grateful for the opportunity to develop products that will help our customers grow their business.”

In terms of customers, Brex continues to serve startups or e-commerce companies, which may be smaller, higher-growth companies. As its previous clients have grown and matured, Brex is now adapting to also serve midsize to larger businesses that have varying financial needs as they grow. This is where Anand seems to offer the greatest value.

Credit: Brex

The landscape for startups vocal about corporate financial needs seems to be getting bigger every day. One of Brex’s best-known competitors, Ramp, is also growing impressively and announced last August that it would $ 300 million raised in a Series C financing round that valued the company at $ 3.9 billion. With its move to serve larger and more established companies, Brex seems only to be moving further into Ramp’s territory.

Nell Mehta, founder and managing partner of Greenoaks, believes Brex has been able to create a card that meets the needs of “modern” businesses and startups. And while that alone was convincing enough to grab his company’s attention, Greenoaks also saw the broader potential for a “truly extensible platform that could solve a universal range of problems,” including better control over employee spending, one “Painless” expense reports and rewards tailored to the specific needs of a company.

“The result is a differentiated experience that translates into great customer loyalty and some of the best growth metrics we’ve seen,” he wrote via email. “In addition, we have always been impressed by the Brex team, which develops excellent products quickly and has a profound vision for the future of business banking.”

Brex has become the “cognitive speaker” for modern business banking, Mehta continues. He praised features like instant onboarding and virtual card provisioning; an “easy to use UX”; no account fees; “Compelling” rewards; and technology “designed to integrate with their customers’ financial operations”.

“We believe that few companies can serve such a variety of companies so effectively, from day one start-ups to demanding companies with complex needs,” he added.

Credit: Co-founders and Co-CEOs Henrique Dubugras and Pedro Franceschi / Brex

The fact that Brex “developed all of the technology from the ground up” is a huge differentiator for the company, according to Dubugras.

“We don’t use legacy third-party vendors like banks, and we’re pretty much focused on high-growth companies,” he told TechCrunch. “Many competitors have single-line products, but you can do your banking with us, you can manage costs, you can get a risk credit line.”

Founded in 2017 by Pedro Franceschi and Dubugras (who are now in their mid-twenties), San Francisco-based Brex was valued at $ 7.4 billion in April of this year following the capital increase a series D. valued at $ 425 million under the direction of Tiger Global Management.

The company told TechCrunch on its latest raise that it is “adding thousands of new tech and non-tech customers on board every month.” Brex also said at the time that it had increased its “total customer base” by 80% in the first quarter of 2021, “with total monthly customer additions increasing five-fold”.

The company expects 1,000 employees by the end of the month. Since it is still geared towards growth, it is not yet profitable.