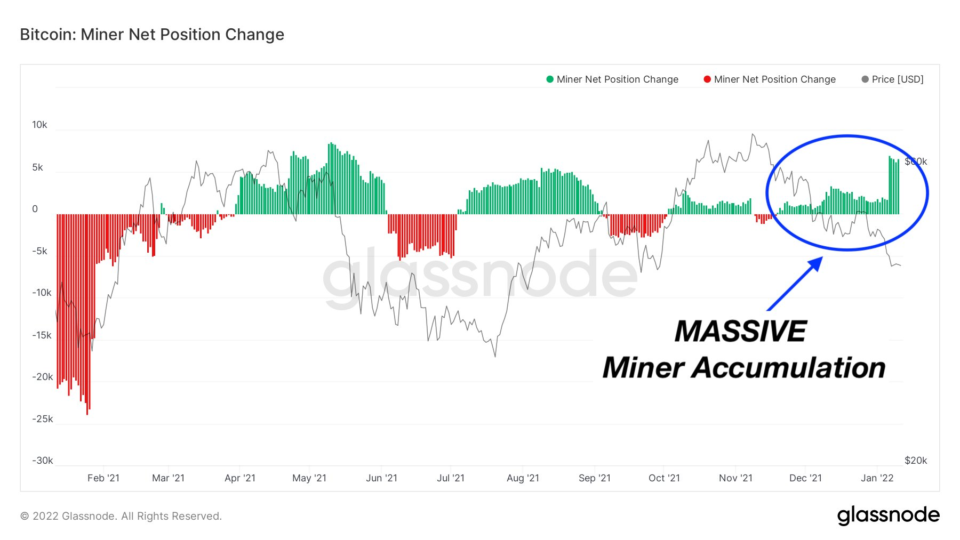

New data shows that Bitcoin (BTC) miners are hoarding more coins than ever in the past five months, which could be a new signal that current prices are not for sale.

The analysis of the Miner-Net position change indicator on January 11th, the on-chain analysis company Glassnode, revealed the popular Twitter account Bitcoin Archive described as “massive” accumulation by miners.

Miners show no willingness to sell

Bitcoin price can be disappointing Spot dealers this year, but longtime entrants are far from concerned.

In addition to strong hands or experienced hodlers, miners are no exception, significantly increasing their BTC holdings in the first two weeks of 2022.

Annotated Chart of Bitcoin Miner Net Position Change. Source: Bitcoin Archive / Twitter

For the past five days, more than 5,000 BTC per day ended up in miners’ books, with actual accumulation constantly since the all-time high of $ 69,000 in November.

More data from other on-chain analysis services KryptoQuant highlighted the extent to which miners have regained their BTC properties since the May riots in China.

Total BTC reserves stood at 1.859 million BTC on Monday, the highest since a sharp decline in late 2020 after BTC / USD surpassed its previous all-time highs from 2017.

Bitcoin Miner Reserve Chart. Source: CryptoQuant

Bitcoin Miner Reserve Chart. Source: CryptoQuant

Hodling the toughest since last January

Returning to strong hands, the proportion of Bitcoin supply viewed as either lost or scared away by long-term investors hit a one-year high this week.

Related: Bitcoin longingly hits $ 30,000 after the May 2021 liquidation copy

To underscore the Hodler’s beliefs, 7.27 million BTC is now off the market – possibly forever.

Thanks to the price dislocation caused by the Chinese mining ban, the figure also hit a low point in the summer.

In contrast, Glassnode is shows, an accumulation trend has accelerated since $ 69,000.

Bitcoin lost or held coins chart. Source: Glassnode

Bitcoin lost or held coins chart. Source: Glassnode