There are financial technology (fintech) companies targeting all sorts of different populations, as well as companies in various stages of growth.

A new company has recently emerged, targeting a popular startup niche and looking exclusively to assist early-stage SaaS (Software-as-a-Service) companies with their financial needs.

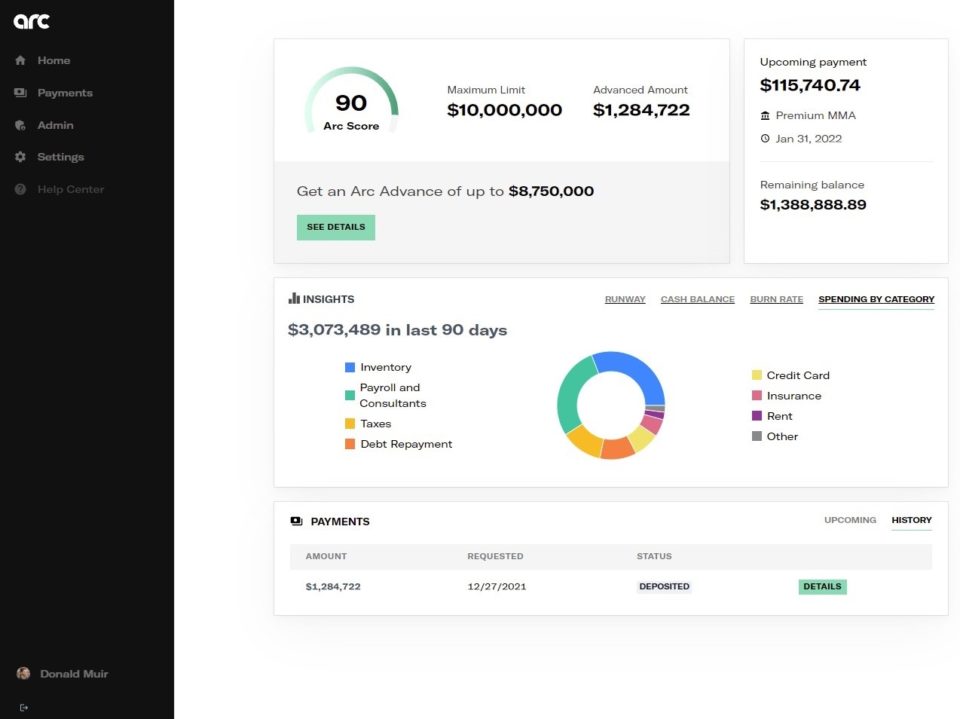

Arc came out of cover today with $ 150 million in debt funding and $ 11 million in seed funding, building a “community of premium software companies” that empower SaaS startups to borrow, to save and spend “everything on a single tech platform.” And that as part of a partnership with Stripe, one of the world’s largest and most valuable private fintechs.

Simply put, Arc wants to help SaaS companies grow through alternative financing methods so they don’t have to turn to venture capitalists to fund their growth at the price of ownership dilution. Those same founders can also avoid the “restrictive covenants, guarantees, and bankruptcy risk associated with incurring debt” by using Arc, said CEO and co-founder Don Muir.

“Early-stage SaaS startups face the infamous cash-for-growth tradeoff – they are in need of funding most, but are also in their most vulnerable state to raise capital as they experience the highest dilution for every dollar raised “Said Muir. “This is exacerbated by the timing discrepancy between monthly cash earnings from subscription software revenue and upfront capital expenditures to acquire new customers.”

Muir, Nick Lombardo (President) and Raven jiang (CTO) founded Arc in January 2021 and incorporated the company in April. The trio formed Arc from Muir’s living room in Menlo Park during his senior year at Stanford Graduate School of Business when the campus was on lockdown due to the COVID-19 pandemic. Prior to studying business administration, Lombardo and Muir worked in private equity and investment banking in New York, where they jointly raised tens of billions of dollars in capital to fund late-stage mature companies. During that time, Muir says, the two experienced firsthand the shortcomings of traditional fundraising — namely, the “slow, offline, and transactional nature” of the transaction process.

“An army of investment bankers, credit analysts, and lawyers will spend months working in data rooms and building static models in Excel to finalize a financing transaction that ultimately costs a company millions of dollars before considering the opportunity cost of management time. Said Muir.

After meeting in Stanford, the trio developed the concept of Arc and then teamed up with Y Combinator to meet hundreds of software founders in the San Francisco Bay Area. Arc was an early member of YC’s Winter 2022 series that began earlier this week.

“We quickly realized that they had a common weakness – financing start-ups is expensive and distracting. Even in a zero interest rate environment, it is extremely expensive to dilute for startup founders. At the same time, offline and bureaucratic banks with outdated underwriting guidelines and limited bandwidth are structurally unable to serve early-stage opportunities, ”explained Muir. “Even software startups with recurring premium income are neglected by traditional lenders. We founded Arc to offer founders an alternative to the status quo. Our mission is to help startups grow – with technology and without dilution. “

Since the company launched its launch product Arc Advance last summer, more than 100 startups have signed up for the Arc platform. To date, most VC-backed clients have been B2B SaaS companies looking to accelerate their growth spend while extending their runway before raising additional equity. So far, VCs have been a powerful customer acquisition channel for Arc, noted Lombardo, who indicated that Arc’s largest partnership today is with Y Combinator, which Arc advertises in its portfolio of thousands of software companies. Arc also works with traditional investors including VCs, banks and venture capitalists. In fact, a large portion of its clients are VC-backed and seek capital from Arc “to smooth funding needs between episodic VC rounds,” Lombardo told TechCrunch. “

For example, he said, “A Series A SaaS company is raising $ 1 million each quarter from Arc before its Series B later this year to accelerate spending – resulting in excessive headcount and revenue growth, and a higher rating of the B series. In this example, the Series A investor also benefits financially from the lower dilution and higher valuation freeing up Arc’s capital.”

Arc’s customers also include bootstrapping companies outside of Silicon Valley, Lombardo added.

The startup is planning in the coming months publish “a full suite” of financial instruments designed to “enable SaaS founders to efficiently scale and stay in control of their business”.

How it is different and the same

Arc differs from traditional financial institutions, which may employ an army of analysts to manually draw transactions, according to its founders, in that it uses technology to algorithmically assess the risk inherent in seed funding.

“APIs provide real-time access to financial data, machine learning increases data value and cloud analytics enable scalable, automated processes,” said Muir. “The result is more flexible, efficient and affordable capital offered to our clients programmatically.”

More precisely, the company is running Back-end API integrations from companies like Plaid to help protect credit risk through real-time access to a startup’s financial data. It uses machine learning “to drastically improve the interpretation of the financial information it receives compared to manual analysis alone”. Finally, by leveraging Stripe’s banking-as-a-service technology, Arc customers can store and spend their funds from Arc “on a single platform built for software companies,” according to the startup.

Credit: arc

To be clear, Arc isn’t the first company looking to help SaaS companies grow without dilution. Buzzy fintech pipe was founded in September 2019 with a mission to give SaaS companies a way to get their income upfront by matching them with investors in a marketplace that pays a discounted price on the annual value of these contracts. (Pipe describes its buy-side participants as “a vetted group of financial institutions and banks.”) The goal of this platform is to provide businesses with recurring revenue streams access to capital so that they do not dilute their property through borrowing or borrowing forced to take out loans.

Do Arc and Pipe have one thing in common? Both allow founders to borrow against their company’s future earnings to grow without diluting their capital.

For his part, Arc emphasizes that although the missions may be similar, its model is different from its competitors.

“We are not a marketplace where we sell customer contracts on a Bloomberg Terminal-like platform. Instead, we build a broader relationship with our customers to help them grow over the long term,” the company says. “This approach results in a recurring, full-service relationship with customers rather than an episodic financial transaction. It also allows Arc to be more flexible about terms and conditions and better serve customers. Arc provides long-term support for SaaS founders and is building a vertically integrated suite of products to serve their financial needs end-to-end.”

It also has a vertical focus on SaaS, believes Muir.

“While competitors have prioritized horizontal expansion, Arc has doubled the SaaS space,” he told TechCrunch. “Our vertical focus enables Arc to meet the unique working capital needs and predictable, recurring revenue attributes of this premium customer profile.”

This vertical industry focus also provides “a unique opportunity for a SaaS startup to network with other SaaS companies through offerings that” benefit all members, “including financial benchmarking insights and community deals, said Muir.

NFX led Arc’s equity round with participation from Bain Capital, Clocktower Venture Partners, Will Smith’s Dreamers VC, Soma Capital, Alumni Ventures, Pioneer Fund and Atalaya Capital Management. Atalaya also provided the credit portion of the investment. A large number of high-profile angel investors also contributed to the round, including over 100 founders from Y Combinator-supported companies such as Vouch, Observe.AI, Eden Workplace, Teleport, RevenueCat, QuickNode, Dover, Middesk, Instabug and Rainforest QA, as well “Several founders of Decacorn fintechs”. The Ex-Stripe-Engel-Syndicate also put money into the round.

NFX founder James Currier, who led the fund’s investment in Arc, has joined the startup’s board of directors in connection with the financing.

“Arc is building the digital native Silicon Valley bank for SaaS startups,” said Currier. “The market for non-dilutive capital for SaaS startups is huge and very early.”

Jared Friedman, General Partner of Y Combinator, compares Arc to more mature fintechs like Stripe and Brex and says the company “created a fintech product with mass appeal for startups”.

And that appeal was another draw for NFX.

“Arc’s vertical focus on SaaS prioritizes the SaaS founder, rather than the buy-side investor, and allows them to build network effects into their software to help community members,” said Currier.

In the last six months, Arc has grown the team from three co-founders to 15 people, including experienced software engineers from Google and LinkedIn, and finance and strategy experts from Brex, Silicon Valley Bank and BCG. The company plans to double the team size in the first quarter of 2022 with a focus on engineering, data science, underwriting and sales.