Amit Anand is a founding partner of Jungle Ventures and an early pioneer and leader in the development of Southeast Asia’s venture capital industry.

More posts by this contributor

- Predicting the next wave of Southeast Asia tech giants

- Investors are doubling down on Southeast Asia’s digital economy

It was only a matter of time.

As more tech companies go public, the necessary disclosure has meant that with access to more information on the financial condition of many startups, mainstream investors have begun questioning just how profitable and sustainable these startups are.

Naturally, this has resulted in some skepticism, and tech firms around the world are slowly changing how they function to address these concerns.

At Jungle Ventures, we have observed the following key trends in how the startup ecosystem is evolving:

Moving beyond demand-side innovation

Building a defensible moat is essential for the long-term success of any startup. For undifferentiated tech-enabled services like food delivery or mobility, user exclusivity is challenging to attain, as the user base is rather flirtatious and has low to no switching costs. In such cases, innovating just to meet customer demand might not be enough. It is interesting to note that startups are now focusing on supply-side innovation to build a long-term competitive advantage.

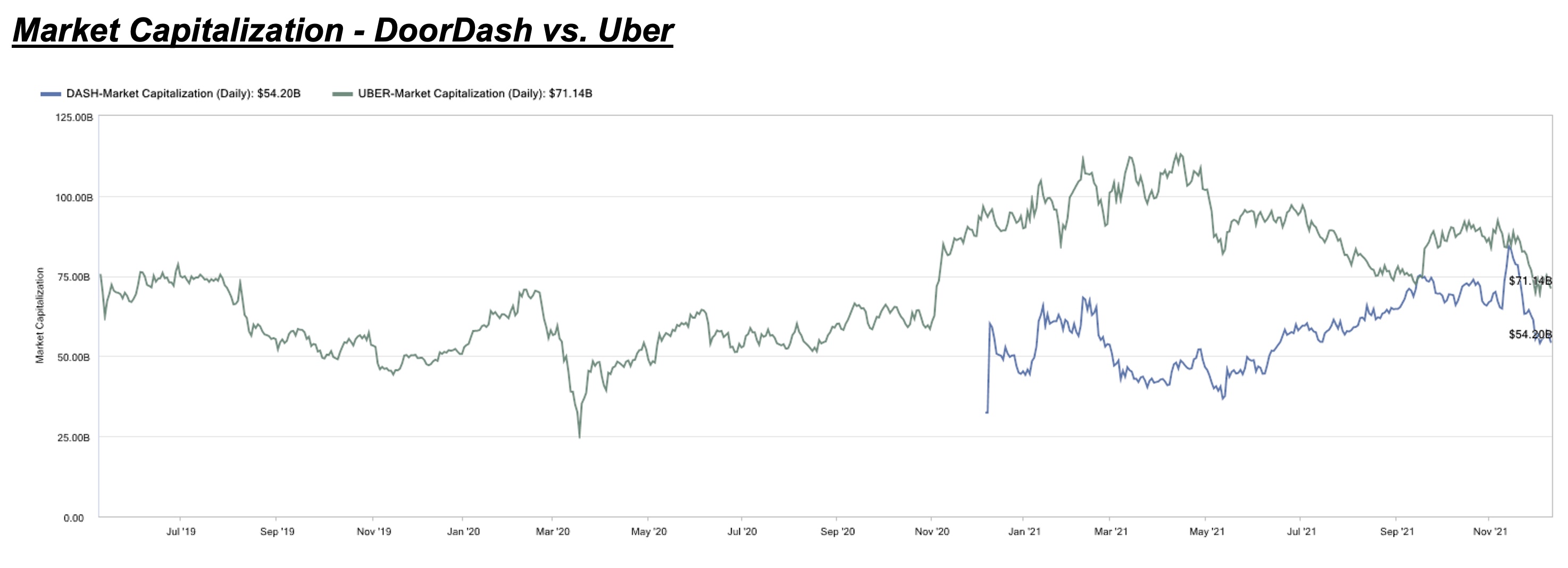

One of these success cases is DoorDash, which has managed to edge out Grubhub and catch up with Uber Eats despite being relatively late to the food delivery scene in the US Instead of just focusing on user (demand-side) acquisition, DoorDash has launched several services to empower its restaurant partners and help them grow their businesses.

For example, DoorDash Drive is a white-label, flat-fee delivery service that lets merchants generate their own orders and use DoorDash to execute deliveries.

The pandemic has also made founders and investors realize the importance of building a resilient business.

We also have DoorDash Storefront, which allows restaurants to create their own online stores (on DoorDash) for pick-up and delivery orders. It provides restaurants with customer data, which other third-party delivery platforms usually do not share.

Such initiatives and value-added offerings helped DoorDash increase its restaurant partnerships (supply-side) and exclusivity, which, in turn, improves user retention and engagement.

Indian food delivery company Zomato also has a similar merchant/B2B initiative called Hyperpure, a one-stop procurement solution that supplies fresh, hygienic, quality ingredients directly to restaurant partners from farmers, producers, mills, etc.

Although Hyperpure represents a small part of revenue (about 10% of its total revenue in fiscal year 2020), the company is planning to invest more than $50 million in the business in the next 18 to 24 months.