Wash trading is when an investor sells and buys the same asset to inflate the value of security artificially. On the other hand, a front-running attack on a blockchain occurs when a malicious user discovers a swap transaction after it has been broadcasted but before it has been finalized and reorders transactions to their benefit.

The NFT market is particularly susceptible to a practice known as wash trading. Several NFT trading platforms allow users to trade without identifying themselves by connecting their wallets to the site. This means that a single user can establish many wallets and link them to a platform.

After that, a person can control both sides of an NFT trade, selling it from one wallet and buying it from another. The trade volume increases as numerous similar transactions are completed. As a result, the underlying asset appears to be in high demand.

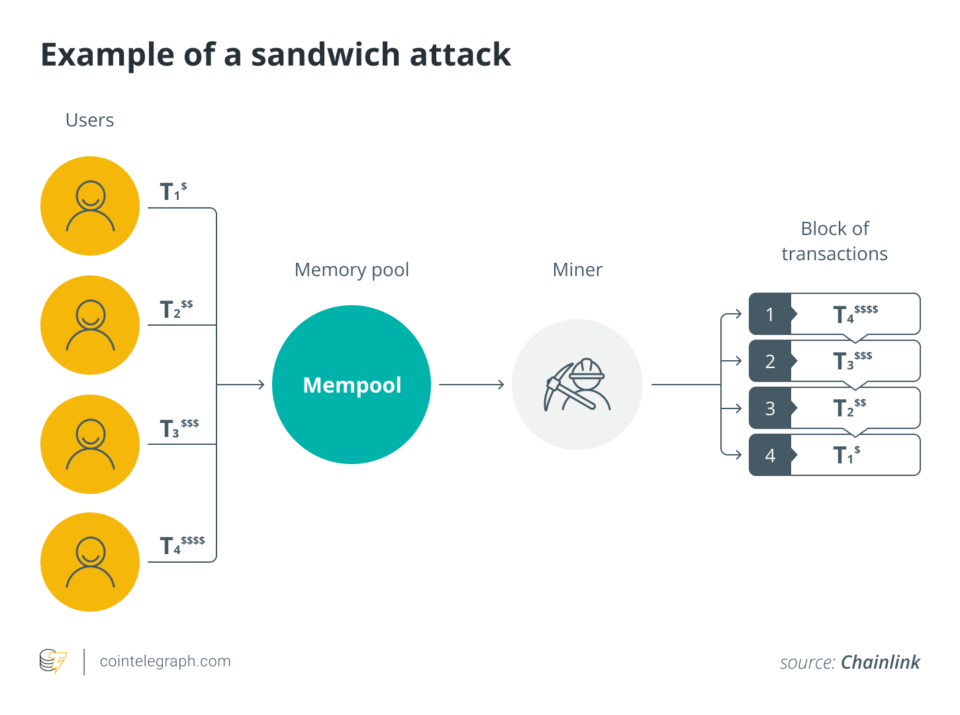

Similarly, front-running tactics like sandwich attacks focus on exploiting DeFi protocols and services. Sandwiching occurs when two orders are placed, one before and the other after the trade. In this case, the attacker will front-run and back-run simultaneously, sandwiching the original pending transaction in the middle.

A victim trades a cryptocurrency asset X, for example, Cardano (ADA), for another crypto-asset Y, for example, Ether (ETH), which is used to make a significant purchase.

Before the hefty trade is approved, a bot detects the transaction and front-runs the victim by purchasing asset Y, ie, ETH.

This purchase action increases the slippage (based on the volume to be traded and the available liquidity, projected price increase or fall) and boosts the price of asset-Y for the victim trader. Because of the high purchase of asset Y, its price rises, and the victim purchases asset Y at a higher price, which the attacker then sells at a higher price.

Another way of front-running includes a displacement attack in which the miner’s transaction replaces the original transaction; the replaced transaction can still be completed, but the result will not be as intended.