Editors note: This article was written and published by Tenjin. You can find their original version here.

Let’s explore how the hyper-casual market has changed compared to 2021 Q3 and go through the top 10 ad networks and countries for 2022. This time we have partnered with our friends from GameAnalytics to bring you day 1 and day 7 retention benchmark in this edition of the report. The full report is available at the bottom of the post.

Hyper-casual ad spend by platform

In 2021 Q3, hyper-casual ad spend by platform was a bit higher on Android (55%) than iOS (45%), marking a decrease of nearly 8 percentage points in ad spend on iOS compared to 2020. In 2022 Q1, advertising spend on iOS and Android now shows a 50% / 50% split, suggesting that advertisers are becoming more and more comfortable with mobile marketing in the iOS privacy-first ecosystem.

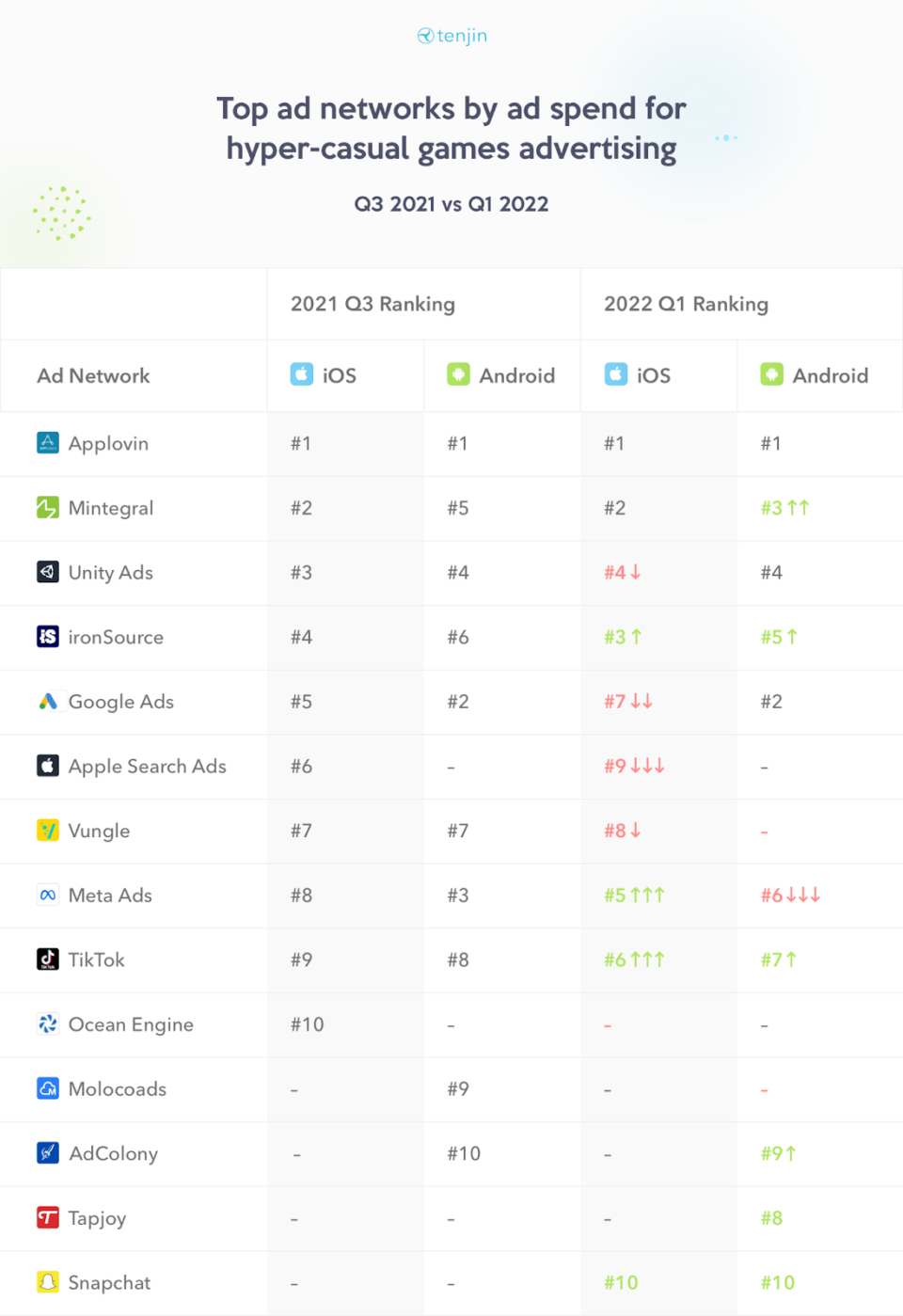

Top 10 ad networks to advertise hyper-casual games in 2022

8 (Applovin, Mintegral, ironSouce, Unity Ads, Facebook, TikTok, Google Ads, Snapchat) out of 10 of the top ad networks by ad spend are common to both iOS and Android. With Vungle and Apple Search Ads remaining specific to iOS and TapJoy and AdColony remaining specific to Android. Below we summarize the ranking comparison between Q3 2021 and Q1 2022.

Note: The naming convention for Facebook has been updated to Meta Ads on the above table and the infographic below.

Top 10 countries to advertise hyper-casual games in 2022

Although the US and Japan are featured at #1 and #2 on both platforms, we can observe key differences in terms of hyper-casual ad spend by platform on a country level. For instance, Android advertisers are spending more in Germany (#3) when compared to iOS (#6).

Additionally, Brazil (#5), Indonesia (#9) and India (#10) are included in the top 10 rankings for Android, but not for iOS so far in 2022.

What’s changed on a country level since 2021? When compared to our Q3 benchmark report, India and Indonesia seem to have replaced Russia and Australia in the top 10 rankings for Android, while Sweden replaced Russia on iOS.

Hyper-casual retention benchmark by platform

The retention benchmark report at the end divides hyper-casual apps that use GameAnalytics, on Android and iOS, into the following categories of retention performance: median (top 50%), top 25% and top 2%.

What exactly do these categories represent? The games retaining their users most successfully, or better than 98% of all the other hyper-casual apps, are represented in the top 2%, and the games retaining their users better than 75% of all others are represented in the top 25% . In other words, we can describe the top 2% of games as “great games,” the top 25% as “good games” and top 50% (median) as “average games”.

The statistics for “Day 1” and “Day 7” retention for each category show that there is a large gap in retention rate between a great game, a good game and an average game on both iOS and Android.

In terms of a comparison by platform, retention rate is better for hyper-casual games on iOS than on Android across all categories.

Maximize the performance of key ad networks

Are you interested in optimizing the performance of your ad networks?

We believe that automated tools, such as Growth FullStackhave empowered marketers to take control of their data and allowed them to make more confident decisions in the post-IDFA era.

Book a demo with Growth FullStack to learn how.