In a May 30 tweetEthereum (ETH) core developer Tim Beiko confirmed that the much-anticipated switch from proof-of-work to proof-of-stake can be expected “around June 8 or so.”

Interestingly, Ether’s price action is relatively unchanged despite the unexpected bullish announcement. There was a +10% spike on May 30but those gains were given back between May 31 and June 2. It is very likely that this event has yet to be priced in, giving traders and investors a possible early entrant advantage.

It’s essential to monitor on-chain data

From an investing and trading point of view, cryptocurrency markets have a distinct disadvantage in comparison with regulated markets and transparency. The stock market is chock full of legally required disclosures. In the stock market, the retail trader can identify how many shares of a stock are short, what institution bought (or sold) a large disclosed amount, what insiders bought or sold and a myriad of other forms of information.

The cryptocurrency markets do not have those kinds of legal requirements. In fact, the public doesn’t know if the Bitcoin (BTC) or Ethereum being bought and sold on an exchange is the real cryptocurrency or a type of internal derivative used to facilitate liquidity. But crypto markets have something better than the stock market and that is on-chain data.

On-chain data allows investors and traders to monitor a blockchain’s network activity. It can answer questions: How many ether are being sent to an exchange? Are there any large transactions? Are any “whale” wallets bigger or smaller? On-chain data can help determine whether a trader or investor should be bullish or bearish.

On-chain data that measure inflows and outflows are often used to determine a bias of whether a cryptocurrency is bullish or bearish. Inflow measurements are cryptocurrencies entering an exchange from outside wallets and are often perceived as a sign of incoming selling pressure. Outflow measurements are cryptocurrencies exiting an exchange to external wallets and are often perceived as a sign of holding or accumulation.

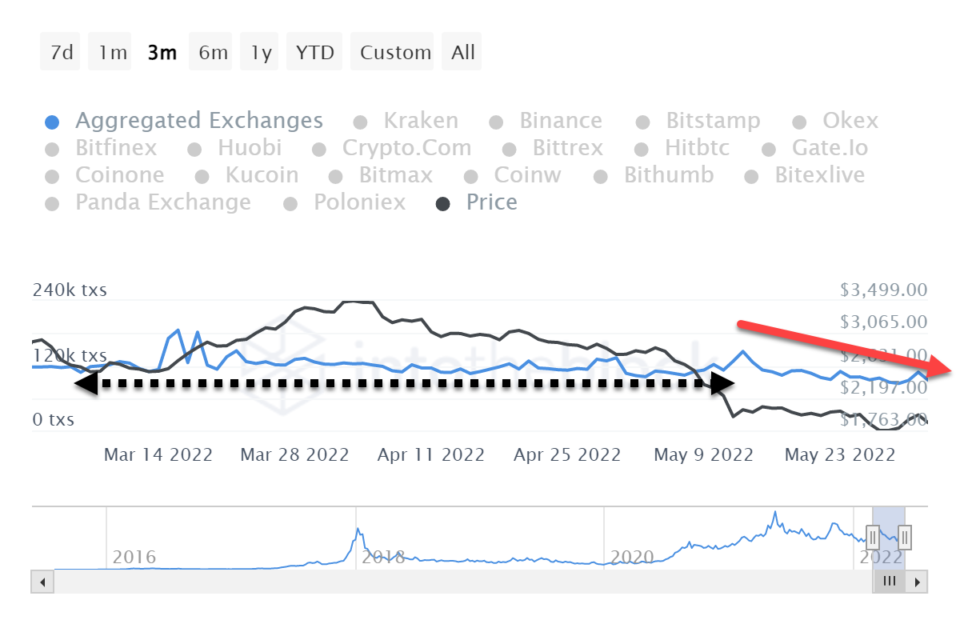

The number of inflow transactions has stayed relatively flat over the past three months, with a noticeable drop since the middle of May.

- Inflow 24h change: -13.50%

- Inflow 7-day change: -5.87%

- Inflow 30-day change: -8.08%

Aggregated exchange inflow transaction count. Source: into the block

However, the number of outflow transactions has declined since March. In addition, there was a major outflow spike on May 12, the date of the most recent Ether flash crash, followed by a resumption of a decline in outflows.

- Outflow 24h change: +3.62%

- Outflow 7-day change: +8.87%

- Outflow 30-day change: -1.56%

Aggregated exchange inflow transaction count. Source: into the block

Aggregated exchange inflow transaction count. Source: into the block

It is important to note that since May 29, outflows have increased and inflows have decreased. This could be a bullish signal that big money is accumulating.

Related: 3 key indicators traders use to determine when altcoin season begins

Ether price remains at major swing lows and oscillators are at historical lows

the upcoming merge event is one of the most significant in Ethereum’s history. It is rare to see the world’s second most valuable cryptocurrency remaining at 200-day lows and down more than 60% from its all-time high.

Perhaps the most important and relevant details for Ether are the position of the relative strength index and the composite index.

The weekly relative strength index remains in bull market conditions, but is just above the final oversold level of 40. The current value of 42.15 is the lowest since the week of March 18, 2019.

The composite index, likewise, is at near a historical low. The composite index, developed by Connie Brown, is essentially the RSI with a momentum indicator. It is an unbounded oscillator and can catch divergences that the RSI cannot. The weekly composite index value is the third lowest in Ethereum’s history and the lowest since the week of March 26, 2018.

ETH/USD weekly chart (Coinbase). Source: TradingView

ETH/USD weekly chart (Coinbase). Source: TradingView

The extreme oversold readings on the Ether weekly chart, rise in outflows and reduction of inflows can give Ethereum investors and traders a good reason to be bullish in the near term. However, any potential bullish reaction will likely be swift and abrupt, but limited to the 2022 volume point of control at $2,600.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.