GoHenrythe UK-based financial education app and pre-paid debit card provider for kids, has expanded into Europe for the first time with the acquisition of French startup pixpay. Terms of the deal were not disclosed.

Founded out of London back in 2012, GoHenry has emerged as one of the preeminent fintech companies for children, targeting six to 18-year-olds with a digital platform that allows parents to allocate and control funds, while their children learn how to budget and gain insights into their spending habits. GoHenry expanded into the US back in 2018, and today the company claims more than two millions users across these two markets — it also says that one-sixth of 12-year-olds now have a GoHenry debit card.

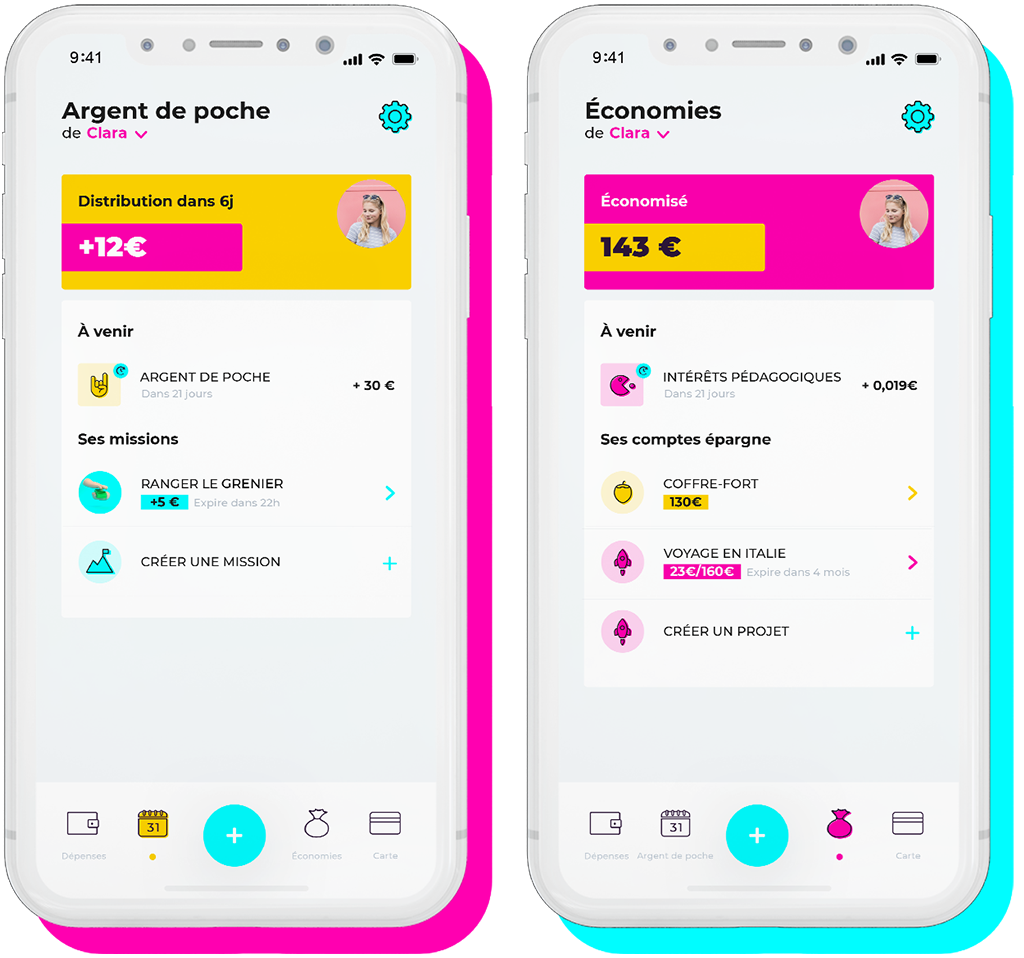

Pixpay, for its part, was founded out of Paris less than three years ago, and is a similar proposition to GoHenry but with more of a focus on slightly older children, starting from 10 years of age. The company had expanded into Spain back in November, helping to drive its membership to nearly 200,000 across the two markets.

GoHenry goes to Europe

In many ways, the Pixpay acquisition serves as the ideal vehicle for GoHenry to expand its horizons. The US, so far, has always been its priority after its domestic market, and when GoHenry raised a $40 million funding round 18 months ago the message at the time was very much about continued expansion in the UK and US But GoHenry CEO Alex Zivoder told TechCrunch that Europe was never far from its thoughts.

“When we launched in the UK in 2012, we pioneered a new category in fintech, and therefore had to grow a whole category from scratch with noone to learn from before us,” he said. “Once we decided we were ready to expand internationally, our timing in Europe was always part of the plan. Our first step was to launch in the US, which we did in early 2018 and have experienced triple-digit year-on-year growth. Following our funding round in December 2020, we were looking for the right opportunity to expand into Europe.”

GoHenry: Mobile app and prepaid debit card

While GoHenry has pretty much had to build itself up from scratch in the US, it’s clear that it’s adopting an entirely different approach for markets closer to home — and there are many advantages to buying an established brand with traction as it has done with Pixpay, perhaps chief among them being that GoHenry doesn’t have to concern itself as much with hiring, localization, and launch campaigns. Indeed, GoHenry said it has no plans to integrate the two companies, with their respective brands, leadership teams, and headquarters remaining as they are.

“As an established leader in teen banking in France and Spain and a trusted brand, the acquisition of Pixpay made perfect sense to help accelerate growth across Europe, improve our competitive advantage, and cement our global leadership position,” Zivoder said.

That’s not to say that there won’t be some resource-pooling going on at some point, however.

“With Pixpay focused solely on teenagers and GoHenry catering for kids as young as six-years-old, this acquisition will allow us to combine our expertise in financial education to the benefit of our members,” Zivoder added.

Pixpay mobile app

Show me the money

GoHenry touts strong growth for 2021, claiming its revenue more than doubled to $42 million, something that Zivoder puts down to — you guessed it — the pandemic.

But what’s the correlation there, exactly? Well, while the company’s core offering is essentially a financial management product that helps parents give their kids some financial independence, it’s also very much about education. Through GoHenry, kids can learn how to budget, while there are so-called “money missions” that deliver mini lessons on all-things finance.

Throw into the mix a broader societal shift away from cash, a movement that has accelerated over the past couple of years, and it seems that GoHenry was well-positioned to capitalize.

“Financial education is a crucial life skill and a secular trend, period,” Zivoder said. “But during the pandemic, the need to teach kids how to be good with money in a cashless world, magnified with social distancing measures and school closures driving more and more people online, and many store owners still no longer accepting cash.”

Money missions: GoHenry teaches kids money skills

The Pixpay acquisition makes sense for GoHenry in terms of powering its expansion plans without having to start from scratch in new markets. With this one deal, GoHenry immediately has two more markets under its wing, and another two scheduled for later this year as Pixpay gears up to launch in Italy and Germany.

And from Pixpay’s perspective, it also makes sense, given that GoHenry already has a significant foothold in two massive markets and ten times the number of members as Pixpay. Consolidation — rather than competition — makes both companies lives easier.

“It made sense to combine our expertise with that of GoHenry to boost our growth plans,” Pixpay CEO Benoit Grassin told TechCrunch. “With shared values and ambitions, we believe that this combination with GoHenry will enable us to go faster and further than if we had operated on our own.”