Amazon’s annual sales event Prime Day delivered more than $12 billion in sales, according to third-party estimates. The retailer hosted the popular shopping event in the US and in more than 15 other countries worldwide on July 13-15. This was the first Prime Day event under the new CEO Andy Jassywho took over Jeff Bezos last year after the Amazon founder stepped down.

The company was bullish on its Prime Day results and said it was the “best ever” mentioning that consumers across the world $1.7 billion. Amazon claimed that it sold more than 300 million items during these sales, but didn’t disclose any revenue figures.

It also noted that it sold “more devices than any other Prime Day,” but refused to put any number to it. The firm said shoppers bought goods worth more than $3 billion on over 100 million items from small businesses across the two-day event.

For weeks building up to Prime Day, Amazon banked on Influencers to drive sales from QVC-style live video shopping. The firm partnered with celebrities like TikTok creators Joe and Frank Mele, Porsha Williams from “The Real Housewives of Atlanta,” “Selling Sunset” star Chrishell Stause, comedian Kevin Hart, and Australian model Miranda Kerr. The company said these live streams generated more than 100 million views but didn’t emphasize how much in sales they generated.

A report from the information paints a different picture: it said some videos of some of its top influencers failed to fetch more than 4,000 live viewers. Amazon is not the only one struggling with live commerce. Earlier this month, Financial Times reported that TikTok is scaling back its plans for live video shopping in the US and Europe.

Amazon didn’t comment on revenue or sales figures registered during Prime Day or through Amazon Live experiences.

Image Credits: Amazon

Since Amazon doesn’t disclose its Prime Day sales numbers, we have to rely on analysts and third-party data to paint a picture of how the event’s sales fared.

Analysts estimated that Amazon sold gross merchandise of anywhere between $12.09 billion to $12.59 billion from Prime Day sales globally. It’s important to note that some countries like India, Saudi Arabia, Egypt, and the United Arab Emirates have yet to host Prime Day sales.

In addition, a report by Salesforce noted that global sales for retailers selling goods on their own sites grew by 8% year-on-year for Tuesday and Wednesday in the second week of July. But sales figures for non-Amazon sites globally dipped by 12% compared to Prime Day 2021.

As usual, major US-based retailers took advantage of Amazon’s Prime Day to offer their own discounts, encouraging consumers to splurge more in an inflation-driven market that has seen prices of different items go high in recent times.

A study from Adobe Digital Economy Index said that total US online spend across online retailers touched $11.9 billion — an 8% increase from last year which saw an $11 billion spend. It noted that the second day of Prime Day sales generated more than $5.9 billion, registering a 9.2% growth from the second day last year, which generated $5.4 billion.

“With the second Prime Day also seeing strong gains, retailers were able to generate approximately $12 billion dollars in online spend, across the two-day event. It’s apparent that consumers are incredibly price conscious, and it will be important for retailers to leverage price effectively, in order unlock new growth potential online,” said Pat Brown, Vice President, Adobe.

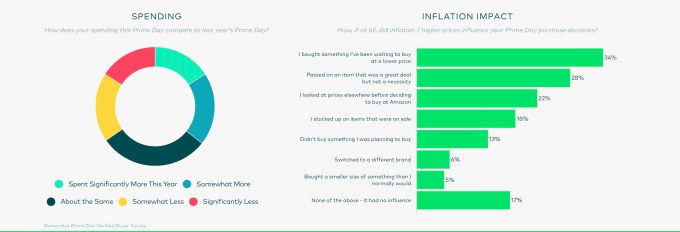

In addition, data group numerator published his own study based on nearly 59,000 Prime Day orders and a survey from more than 4,800 buyers, which said the average order size was up from $44.75 last year to $52.26 on Prime Day sales. It noted that 65% of shoppers who made purchases on both days spent the same or less amount than last year.

The firm’s study highlighted some numbers that indicated Amazon’s influence on Prime Day sales might have dwindled a bit. 24% of shoppers made purchases from another retailer compared to 20% last year; 44% of people considered only Amazon this year as compared to 52% last year; and 34% of people checked prices at other retailers before making a purchase as compared to 33% people last year.

Image Credits: numerator (opens in a new window)

These studies indicate inflation has affected Prime Day sales and retailers might not have seen a major boost in their sales as compared to the last year.

Amazon has had a tough year, as its share prices have dropped from roughly $181 a year ago to $110 at the time of writing. It’s important for the company to drive sales, so much so that it might hold another Prime Day later this year. This year, the company’s workers have also raised questions about workplace safety other dare during the Prime Day sales rush.