Ukio, a short-term furnished apartment rental platform aimed at the “flexible workforce,” has raised €27 million ($28 million) in a Series A round of funding. The cash injection constitutes €17 million in equity and €10 million in debt, and follows some 14 months after the Spanish company announced a €9 million seed round of funds.

Founded out of Barcelona in 2020, Ukio is targeting a very specific subset of society — one that doesn’t like to be tied to a fixed location, either in their personal or professional lives. With the remote work revolution Continuing apace, Ukio wants to give professionals the comforts of home with the added perks and flexibilities of a hotel, with each apartment including a concierge and reception area, while some properties also include a weekly cleaning service and linen/towel replacement.

On top of that, each property’s price includes all utilities (eg, broadband and electricity), taxes and everything you would normally get with a nightly rate in a hotel. All the tenant has to worry about is a single monthly recurring payment they make direct to Ukio, which handles all the maintenance and management behind the scenes.

The company says that the average length of stay in a Ukio-sourced apartment is four to five months, although it supports stays from between one and 11 months. It’s worth noting that guests book initially for a set period of time, but they can extend their stay through Ukio’s online platform.

sourcing

In terms of how Ukio sources its apartments, co-founder Stanley Fourteau says that they adopt a “multipronged supply strategy” targeting individual property owners, real estate developers and family offices. Ukio typically only accepts seven- to 10-year lease agreements with the property owners, meaning that they are obliged to stay on the platform for that duration — but to protect itself from underperforming properties, Ukio only has a one-year obligation, meaning it only has to give notice 45 days after the first year. However, it says that it rarely ever has to do this.

“Ukio uses proprietary tools to source high-quality off-market apartments, based on strict criteria in prime locations in each city,” Fourteau told TechCrunch. “This data-driven supply-acquisition strategy, combined with local real estate knowledge on the ground, ensures that the moment Ukio launches in a new city, we are able to quickly and efficiently acquire a pipeline of high-quality apartments.”

While Ukio’s strategy begins with more of an outbound approach, over time its existing multiproperty landlords often increase their presence on the Ukio platform, according to Fourteau.

“As the brand becomes more familiar and trusted in our markets, we’re seeing a steady increase in existing landlords providing more and more supply, as well as new landlords wanting to partner with us,” he said. “In cities where we’ve been live for more than a year, the number of inbound leads Ukio has averages around 60% compared to 40% for outbound.”

Ukio co-founded by Jeremy and Stanley Fourteau. Image Credits: Ukio

Target market

It seems that Ukio could fulfill two core use cases. A young professional, for example, who can work from wherever they might like might want to sample a new city before committing to a longer-term rental — Ukio would serve that purpose reasonably well. Alternatively, anyone who has landed a new job at a fixed brick-and-mortar office could use Ukio as a stop-gap until they find a more suitable long-term abode. A fully furnished pad with all the trimmings is a lot more appealing than a hotel, or even an AirBnb property, which are usually not well suited for longer-term dwellings.

“Finding and renting an apartment for a month or more is still incredibly complex and time-intensive for modern consumers who are used to doing everything and anything digitally,” Ukio co-founder Jeremy Fourteau said. “Ukio was created to overcome this challenge.”

The main appeal for tenants is that Ukio essentially shields them from the hassles and restrictions of traditional rental models. But that, of course, comes at a premium, with the cheapest property starting at around €1,750 per month and ranging all the way up to €5,000. Since the start of the year, Ukio said that it has seen seven-fold revenue growth year on year, with a 96% occupancy rate across the 400-plus properties it currently has listed.

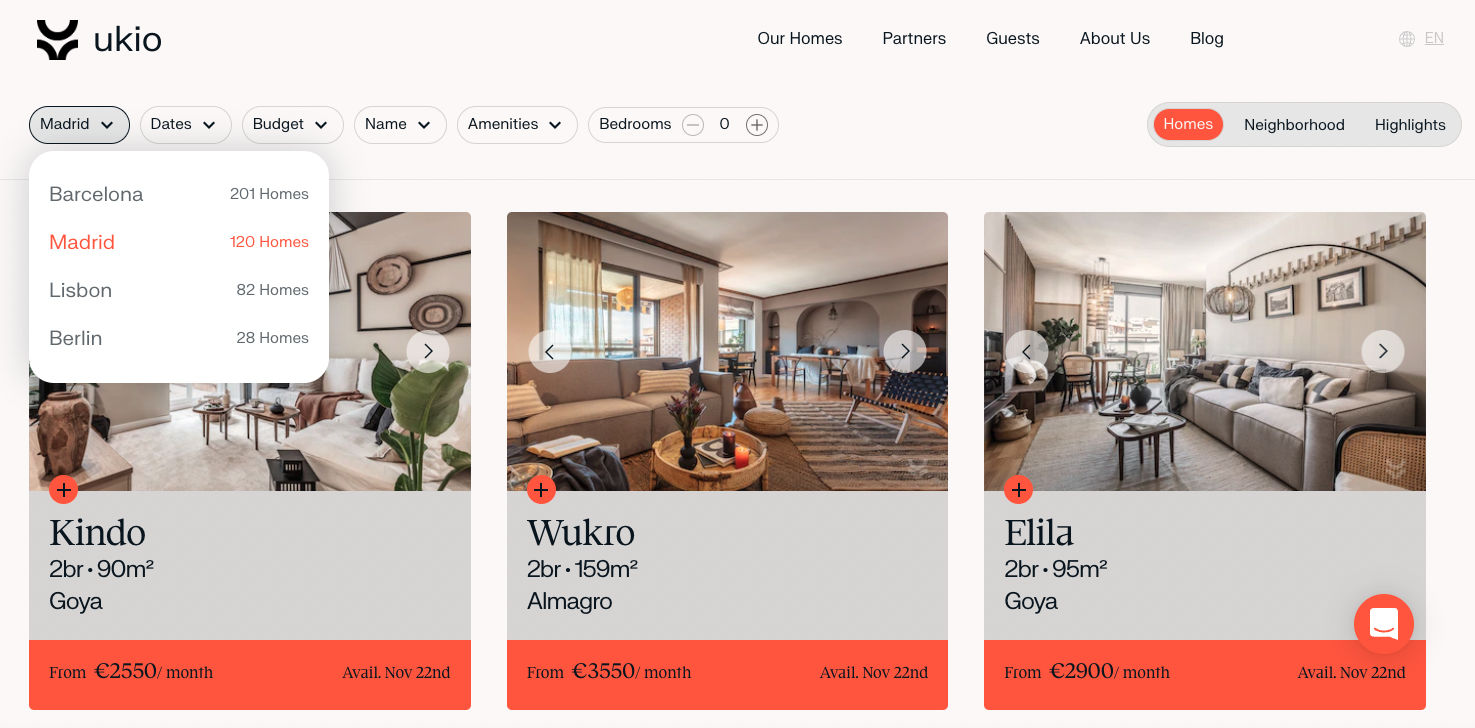

The Ukio platform. Image Credits: Ukio

For now, Ukio is most active in its native Barcelona and Madrid, where it claims 210 and 125 apartment rentals respectively. But it has also expanded into Lisbon (Portugal) and Berlin (Germany), with Paris and Milan on the horizon for the coming months, followed by London and Dublin, among others.

This expansion is what Ukio’s fresh Series A investment will essentially fund, while it said that it’s also working on a B2B offering for businesses growing their international footprint.

Ukio’s raise comes as several similar platforms have raised sizable rounds of funding. Birmingham, Alabama-based Landing recently secured $125 million in a series C round of fundingwhile San Francisco’s Zumper raised $30 million as it doubles down on flexible short-term rentals. Last year, New York-based Blueground raised a chunky $140 million.

Ukio, for its part, is all about Europe and it will remain so “for the foreseeable future,” Fourteau said. The company’s Series A round was led by Felix Capital, with participation from Kreos Capital, Breega, Partech, Heartcore, Bynd and a host of angel investors.