Binance, the world’s leading crypto exchange by trading volume, will temporarily suspend bank transfers in US dollars. The exchange stated in a tweet on Feb. 6 that no other trading methods would be affected. The announcement came with no explanation. However, exchange CEO Changpeng Zhao noted in a tweet that only 0.01% of the exchange’s total users will be affected by the suspension while assuring that they are looking to resolve the issue soon.

Recently, Binance encountered related financial issues in the US On Jan. 21, its SWIFT transfer partner, Signature Bank, announced that, as of Feb. 1, it would only accept trades from clients with US dollar bank accounts over $100,000. The bank had previously declared that it was severely restricting deposits from cryptocurrency consumers.

At the time, Binance stated that it was looking for a new one SWIFT partners and that all SWIFT trades involving other currencies, as well as trading in US dollars using credit or debit cards, will continue to be accepted.

Signature Bank’s most recent action comes after it disclosed plans to sell up to $10 billion in crypto deposits in December in an effort to reduce its exposure to the turbulent market changes. “We are not a cryptocurrency bank. We don’t want to be obligated to any particular sector or client,” Joe DePaolo, the bank’s CEO, said at the time.

A Binance spokesperson told Cointelegraph, “We are pausing USD bank transfers as we upgrade our services. We have contacted affected users directly and regret any inconvenience this causes,” adding:

“We are actively working to find an alternative solution for SWIFT bank transfers. We have since paused all USD bank transfers as we work to upgrade the service. 0.01% of our average monthly users use US bank transfers.”

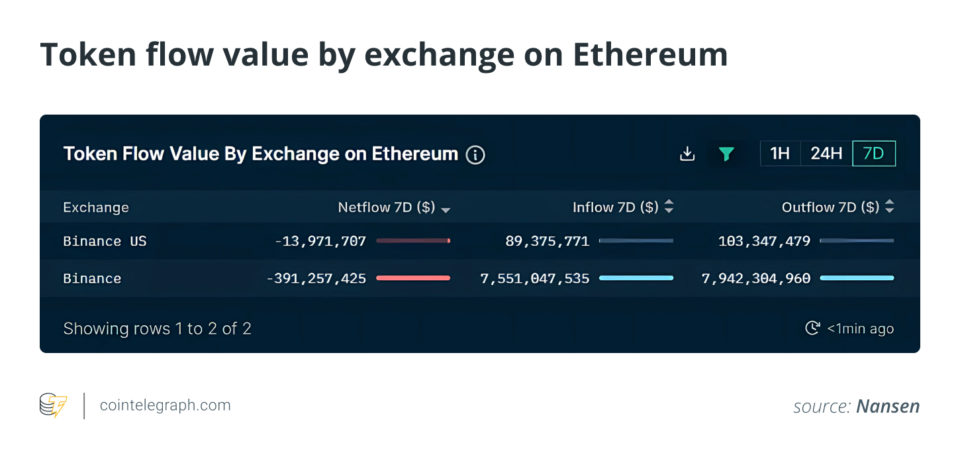

Nansen data shared with Cointelegraph shows that notable stablecoin movements include crypto trading group Jump withdrawing $160 million in stablecoins and Oapital, a digital asset investment firm, withdrawing $230 million.

Andrew Thurman, head of content at Nansen, told Cointelegraph, “Jump and Oapital are large players who routinely sling around large sums, however, and it’s difficult to fully attribute the movements to the banking announcement. I’d say the seven-day outflows might be a little high, but the 24-hour inflows show it’s nowhere close to panic.”

Turmoil in crypto market makes banks cautious

Banks are generally hesitant to deal with digital assets, especially without uniform regulations governing the nascent market. In many countries in the European Union, this turned into a total ban on a national regulatory level until the Markets in Crypto-Assets package, a pan-European regulatory set for digital assets, enters into force.

For banks, the most important thing is to remain part of the financial system, and if they feel that they could be cut off because they took too much risk, they will simply not take it to begin with.

Tony Petrov, chief legal officer at compliance-as-a-service provider Sumsub, told Cointelegraph that the ongoing bear market is another reason behind the bank’s recent action, stating, “When the crypto market was skyrocketing, some banks were simply pushed into the open arms of crypto exchanges: They had no bad reputation, their open faces inspired confidence, and the concern that most of the banks had little or no understanding of crypto industry could not beat the unprecedented figures of profits that one could make in crypto.” He continued:

“But the time to scatter stones may be replaced by the time to gather them. And now some banks that were actively involved in crypto may rethink their involvement and change their policies.”

He added that crypto businesses will make an effort to “reinstate their reputation, and for that, they will need more stringent compliance infrastructure. Ideally, some third parties guarantee the required levels of risk management, to harmonize the approaches of crypto exchanges and banks and to return mutual trust on both sides of global finance.”

Lars Seier Christensen, the founder of Saxo Bank, believes the developments around FTX and other crypto disasters, combined with the low volumes in the market, have hurt confidence in the industry. Banks believe the benefits associated with crypto trading activity are not proportional to the increasing regulatory and business risks.

Clearly, the more difficult the access, the fewer new clients and deposits will find their way onto exchanges, adding to the problems they are already having with low volume. Talking about how crypto exchanges can mitigate this hurdle, he explained:

“A number of credit card companies still support payments to companies that banks often place restrictions on, such as gambling, adult sites and others. But the best thing the industry can do as a whole is to embrace and welcome clear regulations and adhere strictly to them, as well as help shape them with their knowledge.”

Eddie Hui, chief operating officer at crypto exchange platform MetaComp, told Cointelegraph that it is not uncommon to see an increase in bank runs on exchanges where clients try to withdraw their cash at the same time.

Reducing exposure to crypto and trying to diversify the client base would mitigate such risk. Understandably, it is a sensitive decision to make for banks and their shareholders, who may have been burnt by the crypto market in 2022.

He added that, in the case of Silvergate, the restriction they imposed was on transactions below $100,000. Some exchanges may decide to bundle withdrawals and to go “through scheduled withdrawals using a third-party payment company, but that may introduce additional costs, delays, operational burden and counterparty risk.”

Hui further commented: “The bottom line is that workarounds may exist, but it is unfortunate to see the gap between crypto and banks widen again, as the end client will be paying the price of those changes.”

The recent action of Binance’s USD banking partner raised many eyebrows in the crypto community, especially after a disastrous 2022 that saw many crypto goliaths fall from the top, confidence in the crypto ecosystem taking a hit. While regulatory bodies have said that crypto will be their priority, experts believe uniform regulations are a must to build that trust back. Until then, exchanges will have to mitigate the hurdles and risks on their own.