Rhys Spence is Head of Research at Brighteye Ventures, a European edtech-focused fund, where he works with portfolio companies to set priorities, with a focus on internationalization and HR.

More posts from this contributor

- What we can learn from the expansion efforts of edtech startups in Europe

- The edtech avalanche of 2021 has only just begun

Even recently In 2019, the edtech ecosystem could have been likened to a shallow well. Funding and activity were concentrated in a few markets and few growing companies showed interest.

But that is no longer the case. Gone are the days when pitches for VCs had to overcome skepticism about market size and consumer willingness to adopt technology-enabled learning solutions.

2020 will be remembered in educational circles for the hubbub it caused in schools, universities and workplaces. But it will also be remembered as the year the industry woke up to the solutions being developed by edtech companies to help people learn faster, cheaper, more efficiently and more effectively.

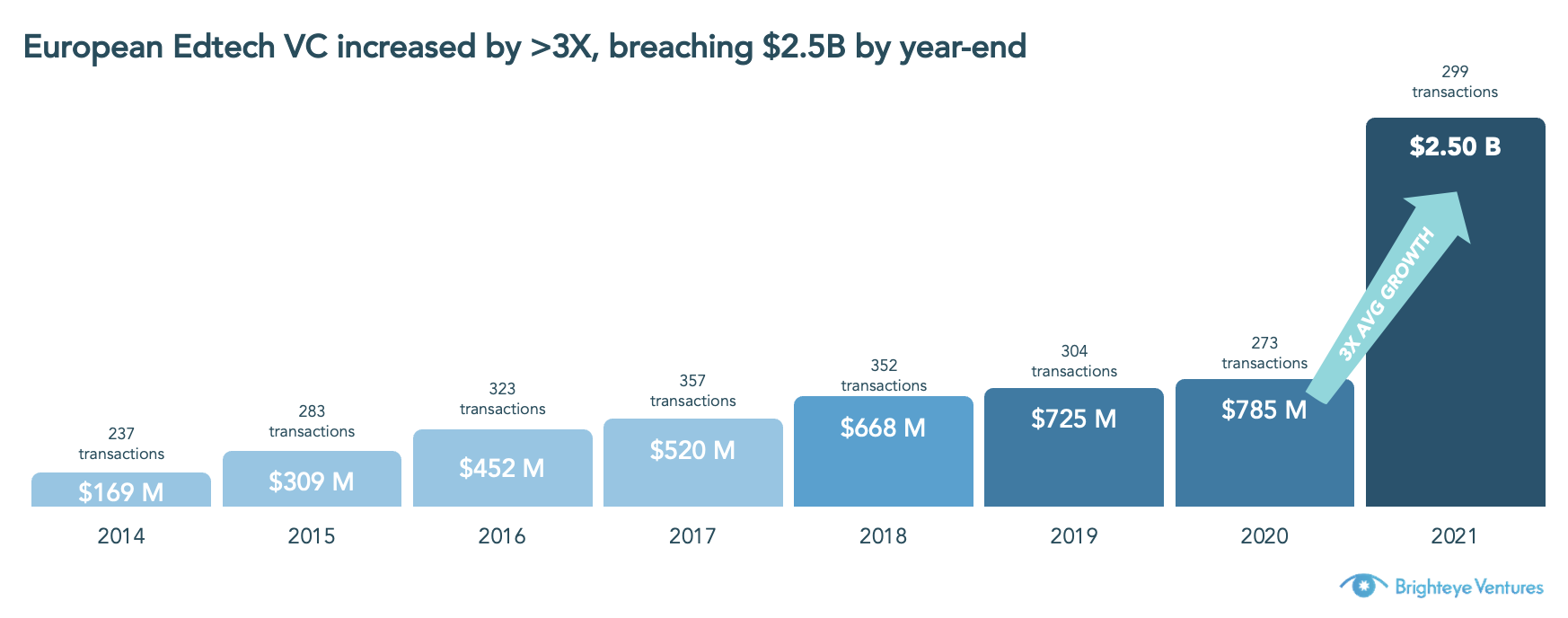

Unsurprisingly, 2021 saw a boom in edtech investing across a spectrum of investors. In fact, edtech investments in 2020 and 2021 equaled the amount raised throughout the entire 2014-2019 period.

To continue the original metaphor, the edtech ecosystem is now a deep, thriving lake. Exciting companies are emerging across geographies and industries, and even general investors are building a belief in the sector’s ability to produce the same kind of outsized returns that are being produced in fintech, healthcare technology, and other sectors.

Generalist investors are drawn to the sector for both financial and positive impact returns, giving more competition to specialist funds.

Our funding report 2021, to be released today, highlights key global growth and activity metrics in the edtech space, with a focus on Europe. We mainly used data from Dealroom, which we used to develop an edtech-focused one data platform.

A year of records

First, European edtech VC investments tripled from $790 million in 2020 to $2.5 billion in 2021, compared to global funding growth of 34% to $20.1 billion in 2021 of $15 billion in 2020. The continent’s ecosystem is also becoming more resilient — the number of edtech deals in Europe accounted for 31% of all deals in the industry, up from 21% in 2019.

Photo credit: Brighteye Ventures

That growth wasn’t limited to the usual geographies: Six European markets raised more than $100 million in 2021, compared to just one in 2020. Most of these markets are in Northern Europe, so we’re hoping and expecting some Big players to see outbreak in southern Europe in 2022 (particularly in Spain, Portugal and Italy).