Nikhil Sachdev is a managing director at Insight Partners, where he focuses on investments in high-growth software, fintech and crypto companies.

Apoorva Goyal is a vice president at Insight Partners, where he focuses on investments in high-growth fintech, internet and software companies.

Charles Vojta is an associate at Insight Partners, where he focuses on diligence and supporting software investments with a focus on crypto, fintech and infrastructure providers.

Crypto has had a rough couple of months as much of the downward macro pressure hammering software and fintech hit the broader crypto market. Valuations have collapsed, revenue growth (for many companies) is starting to slow down, and institutional and retail capital is pulling back at scale.

One area of crypto that is weathering the storm quite well is “infrastructure,” the companies and protocols that help enable the core functionality of other crypto companies. Despite seeing negative price pressure mostly in line with the broader market, these infrastructure companies have continued to generate sustainable revenue by servicing emerging but clear, durable use cases.

Furthermore, many of these companies are expanding horizontally and vertically to become true enterprise-grade infrastructure, a process expedited by the large influx of capital and Web 2.0 talent in the space.

Looking forward, we expect companies and protocols focused on building critical infrastructure to continue to emerge and scale, driving attractive investment opportunities.

The six-layer cake model

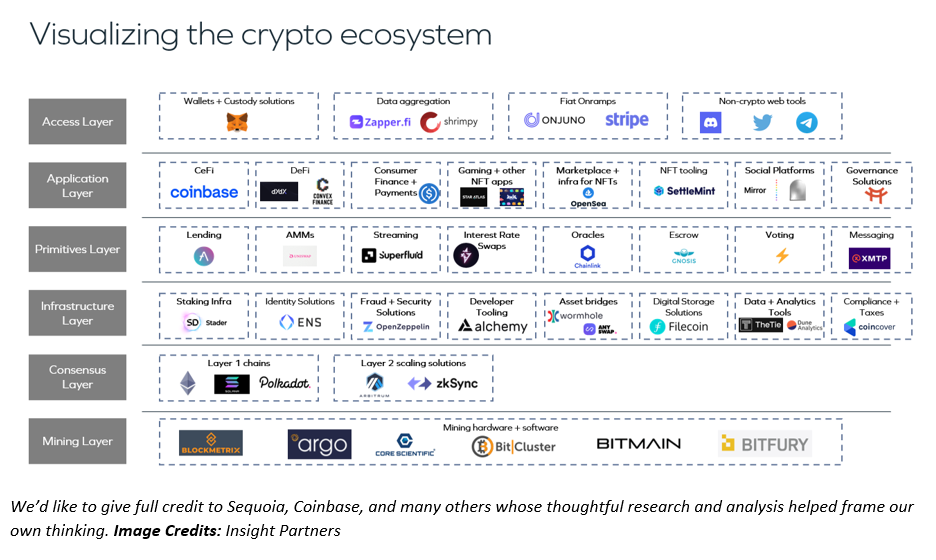

To better understand the crypto landscape, we unpacked the sector into its core technology layers, which culminated in a six-layer crypto stack, ranging from the basic settlement/mining layer, all the way through the consumer-facing decentralized application and access layer.

We see huge value in tools that abstract and enable fundamental activities in crypto.

Between these two extremes is a spectrum of infrastructure providers, hybrid infrastructure application tools known as primitives, and composable applications that codify, enable and make accessible the various use cases across the crypto ecosystem.

Image Credits: Insight Partners

Imagine a consumer wants to swap ETH for another Ethereum-based token on a decentralized exchange — a swapping protocol that lets two assets trade against each other without an order book.

The initial set of steps for this consumer exists in the access layer. This layer is focused on giving individuals or institutions the tools to interact with decentralized applications and networks. For our swapping example, the access layer will equip consumers with a few key essentials: